The chances are, you fall into one of three tribes when it comes to crypto.

The first is that you are pro crypto, and bullish.

The second is that you believe crypto is a bubble or “scam” etc. and are bearish.

The third is that you still don’t know what crypto is and how it works, which means you’re likely more inclined to join the bears than you are the bulls.

This article was written by Chris MacIntosh of Capitalist Exploits.com.

If you’re a bear, you’re going to have a hard time arguing that crypto is in a bubble, because the first thing I’d ask is “compared to what?”.

When compared to what we usually measure bubbles in, like any major index like the S&P 500 or the bond market, that argument won’t really fly. There are well-established conventions for valuing a stock or index… how do you value a rare “escape valve” for capital outside of the monetary system that allows capital to be privately transferred almost instantly?

Further, the “stimulus” in the last year alone has risen asset prices to extreme levels across the board. Bitcoin may have been a recipient; but so has a lot of things.

So unless you want to compare the price of Bitcoin to the price of something that hasn’t seen wild capital flows like… I don’t know… bananas, you can’t really argue that it’s in a bubble, even at the all time high prices we are currently seeing.

And arguing it is a scam is fine, if you could point out how it’s a scam.

But you can’t, no one has, and it seems increasingly obvious that proponents of this argument are either politicians, or clueless (and obviously, there’s a massive overlap there), and conflate Bitcoin with all sorts of shitcoin.

To be fair, Carlos didn’t help.

For full disclosure from the outset – we hold Bitcoin and Ether positions, and have been recommending these since even before the start of Insider and our fund.

When we first officially recommended Bitcoin to clients (@ $450), we were mostly met with raised eyebrows, and a lot of questions.

Since then we’ve written many reports on it, frequently covered it in our newsletter, taken many questions from our Insider members at our monthly Q&As, sought guidance from experts, held many long conversations with incredibly bright investors on it, and generally kept abreast of all the goings on seeing it is still one the themes in our portfolio.

That is to say, we have a deep enough understanding of what it is, the market for it, and its potential future role in the world.

But although we still recommend buying Bitcoin, it won’t be for much longer. This separates us from most out there who hold Bitcoin, and think the wide scale adoption of it is inevitable.

Over the years, much has happened to solidify crypto as a mainstay.

We had the ICO meltdown a few years ago, which flushed out a lot of “investors” and created a great buying opportunity.

We’ve had the WallStBets story that exposed the state of the financial system’s “health”, pushing more people into crypto.

We’ve had the recent run, which our governments’ increasingly preposterous interventions have no doubt contributed to.

And we may soon have Turkey introducing capital controls, which would give Bitcoin a whole new fuel tank.

In 2013, when Cyprus led the way in the “bail in” movement, bitcoin’s price surged, but so too did adoption. As Bloomberg wrote:

“Since Sunday, a trio of Bitcoin apps have soared up Spain’s download charts, coinciding with news that cash-strapped Cyprus was planning to raid domestic savings accounts to pay off a $13 billion bailout tab. Fearing contagion on the other end of the Mediterranean, some Spaniards are apparently looking for cover in an experimental digital currency.

‘This is an entirely predictable and rational outcome for what’s happening in Cyprus,’ says Nick Colas, chief market strategist at ConvergEx Group. “If you want to get a good sense of the stress European savers are feeling, just watch Bitcoin prices.”

The value of the virtual currency has soared nearly 15 percent in the last two days, according to the most-recent pricing data. “One hundred percent of that is due to Cyprus,” says Colas. “It means the Europeans are getting involved.”

That Spaniards would consider converting a portion of their dwindling savings into a peer-to-peer currency vulnerable to wild price fluctuations and the odd thieving Trojan speaks volumes about banking confidence in some parts of Europe. As German economist Peter Bofinger warned in an interview with Spiegel Online: “European citizens must now fear for their money.”

Now imagine the effects of a population roughly 80 times larger going down this road…

We’ve also seen the adoption of blockchain technology into real world applications and the signalling from banks and corporations that it is actually a legitimate and worthwhile technology to pursue, during all this time, and China’s march toward releasing the first Central Bank Digital Currency (CBDC).

Today, we also have a never ending lineup of “experts” and “gurus” shilling crypto, along with a gamut of newsletters and services designed to profit from a trend.

This concentration of excitement and optimism around crypto has set up echo chambers, where on one hand, you have the mainstream financial media and the forces it represents, and on the other, you have the alt financial media that has its own incentives and biases.

What we increasingly do not have and desperately need, is functioning journalism, independent, critical thinking, and discussion from more than one side of a story.

This is crucial for proponents of Bitcoin as it is proponents of a free and prosperous society.

Over the last years and decades now, the mainstream media has proven untrustworthy, biased, protected by large corporations or governments, and incapable of independence and intellectual rigor.

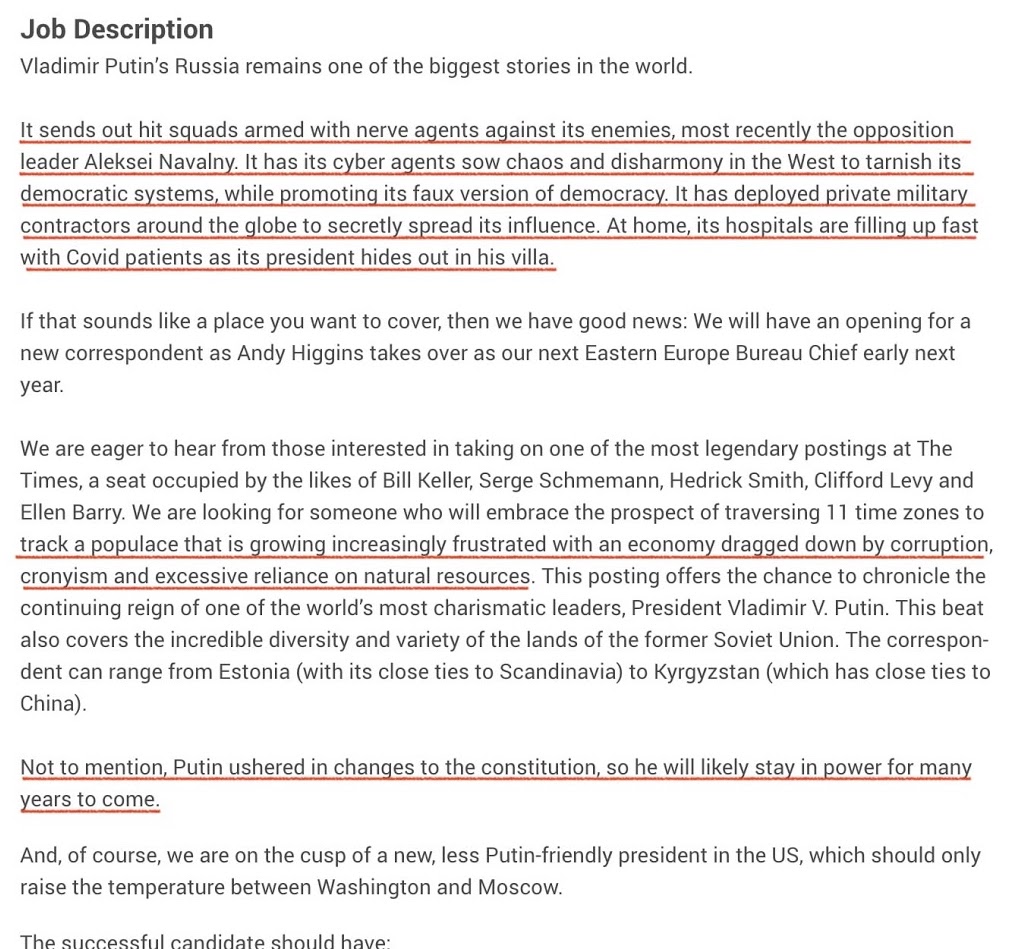

Check out this job advertisement for a Russia Correspondent from the New York Times as a brief example:

Whether any of the claims highlighted in this job post are valid or not is missing the point: what does any of the text underlined in red have to do with hiring someone?

This is a clear example of how real journalists are excluded from being hired by these news outlets – if you don’t agree with the claims made in the advert, and report accordingly, don’t even bother to apply.

Real journalism takes a back seat running a news outlet these days.

The masses have been waking up to this, and have grown so distrustful of the “fact checkers” and broad censorship that they’re flocked en masse to the “alt media”.

That’s good, right?

Not really, no, and I’ll tell you why.

Alt media journalists are not typically trained in the rigor of journalism.

In other words, what we have now is a whole army of content makers straying from the journalistic method while presenting their findings as fact.

This is generalising of course, but what you have is largely a bunch of people who became fed up with the status quo, took it upon themselves to do research, and became self appointed “journalists”.

Now, before you head to the comments section to tell me off for not supporting open source information that benefits everyone, please hear me out.

The problem is not with the people or their intentions, which are noble and essential to a free world. Being a true journalist these days takes enormous bravery and sacrifice – see Julian Assange, Ed Snowden, Glen Greenwald and others who are being hunted right now.

People that perform real journalism – where facts are verified and reported often to the chagrin of the status quo – deserve medals. They are key to a free society in which all ideas are exposed to criticism and debate, and therefore key to financial markets, as facts allow accurate price discovery to occur.

The problem is these people are too few and far between; they are the exception and not the rule.

The journalistic standard – the process of fact finding and verification – is not being upheld in alt media, just like it isn’t in the mainstream world. You either have the “blue pill” journalists being indoctrinated by university to glide into jobs where a predetermined narrative exists, or you have “red pill” journalists who recognise this and essentially rebel, taking the opposite side on any issue being covered.

This is true whether the issue falls under climate change, social justice, covid or the financial system.

While the status quo is guilty of propagating hot steaming piles of bovine manure about Bitcoin (it’s a scam, its uses are nefarious etc.), the alt financial media and its gurus are just as guilty of getting swept up in their own hype.

It goes something like this: crypto is the future, nothing can stop it and we’re all going to be rich.

It’s the same dynamic playing out with Wallstreetbets and its war against the financial establishment – hype that is aimed at changing the status quo and democratising the economy, because the government can’t… or won’t.

Both the establishment (hedge funds, brokerages, media, govt officials) AND the rebels (from teens using their stimmy cheques to gamble to long time anarchocapitalists) – what matters is beating the enemy, making money or both.

Little attention is given to the nuances.

And there are always nuances.

So with this as our backdrop, I was recently sent this article entitled “Every Reason Bitcoin Will Not Fail”, where the author provides an entire list of rebuttals to as many arguments against crypto as they can.

It was interesting to see an article take on many arguments against Bitcoin, instead of parroting arguments for Bitcoin.

But unfortunately, the same issue still troubles us with Bitcoin, that neither this article or anything we’ve seen properly addresses.

And that is:

Government.

The government is a force that likes competition in the same way that the Mafia do.

If you’re wondering what that means, it means they will ban Bitcoin at some point.

If you think the government cannot simply “ban” Bitcoin, you’re probably thinking about it the wrong way.

A government would have to ban the internet to ban Bitcoin (which by the way just happened in Myanmar, but anyway…).

This is one of the biggest arguments that proponents of Bitcoin and blockchain have – it’s impossible to do, given society relies on the internet, so governments cannot simply ban it, it won’t happen.

But let me ask you…

Would you buy bitcoin if you needed a (very expensive) banking license to?

How about if the government issued hefty fines for trading it?

What about 10 years in prison for buying it? Or worse?

Sounds whacky, doesn’t it?

Well, the state of Western Australia in good ol’ cruisy laid back Australia recently imposed $50,000 fines for you if you’re caught not wearing a goddamn mask.

If I’d told you that in December of 2019, you’d have called me a lunatic.

And yet, here we are.

Just like if I told you in 2019 that an entirely factual article I wrote on clean energy got everything we publish censored, because it triggered some faceless, incompetent, virtue signalling “fact checker” at Facebook, then you’d have said I was a paranoid lunatic.

And yet, that happened. Try sharing any of our content, chances are many won’t even have the guts to now, because of the atmosphere of censorship and the social pressures it creates makes it not worth it.

Most people are cowards.

It is the human response mechanism to danger and entirely understandable, even if not noble.

This is how governments can ban things, without banning them.

It’s almost maddening that people still cannot understand that what is going on politically in the West is the most important thing in determining your financial future, but I guess they’re going to have to find out the hard way.

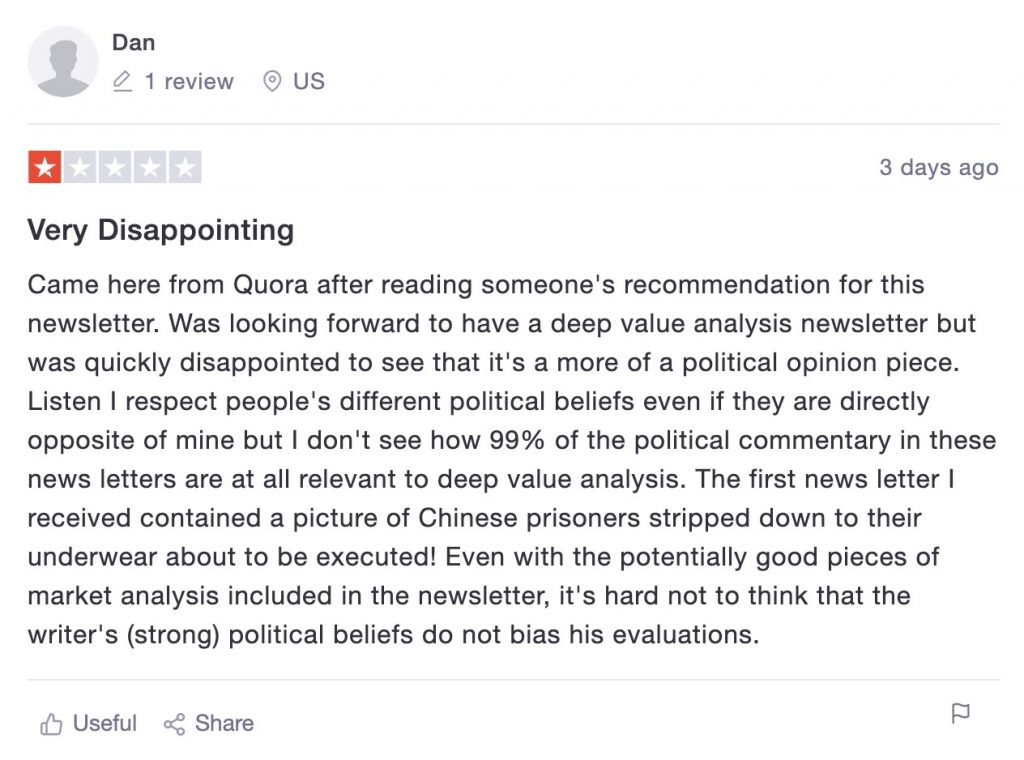

Like this guy, writing about our Insider Weekly newsletter:

To reiterate, we have zero political affiliation and have zero to gain by supporting one party over another. Our view is that while people probably get into politics for good reasons, those who achieve any level of power are mostly sociopaths who want to amass more power and control society rather than “serve” it.

Clients do not pay us to be supporters of these beloved “leaders”.

They pay us to understand reality, forecast outcomes, and position their capital accordingly.

That is our only interest.

If readers believe that we are in support of any political leader or movement, it’s probably their own insecurities being reflected in how they interpret our writings.

If we’re critical of “climate science”, we must be fossil fuel loving “climate deniers”!

Our objective at the end of the day is to understand probabilities, and you cannot do that without understanding reality – not the reality you see on the news… actual reality.

This is sometimes too uncomfortable to address for people who think investing involves dressing in a suit and looking at charts. I haven’t done the former for 20 years.

It’s equally difficult for those who hold their future hopes of financial freedom and the world being a better place on the success of Bitcoin.

As well as being a proxy for the generational war that’s going on between boomers and those younger who will own nothing and be happy according to the Davos crowd, Bitcoin promises what real estate did for the boomers… it gives normal people the opportunity to be wealthy by simply owning an asset that will appreciate substantially in price.

And this emotional dependence people have placed on Bitcoin and crypto in general being the answer to many of the world’s problems, is where their ability to understand reality falters and their judgement gets clouded.

How Bitcoin gets banned and on what timeline, I do not profess to know.

But I believe it does, and here is a brief summary of why:

Crypto and Bitcoin in particular provide a unique hedge against inflation, while providing an efficient means of transportation of value.

That’s a problem because it will send a significant signal to the technocrats who completely pha-cdup the monetary system, that there is competition to their own CBDC they wish to be dropping on us.

That is simply how the probabilities stack up.

We remain long… for now. But I’d encourage you to consider these thoughts, position size accordingly, and plan for Bitcoin to eventually be designated as a tool used by “terrorists” to threaten national security or some such nonsense.

From Forbes:

“In 2018, Yellen also warned that “many” Bitcoin transactions are “illegal, illicit transactions”—an opinion echoed by a recent U.S. Department of Justice (DOJ) report that found the emergence of Bitcoin and similar cryptocurrencies is a growing threat to U.S. national security, with the attorney general William Barr’s Cyber-Digital Task Force calling it the “first raindrops of an oncoming storm.’”

If you think the short stumpy lady will reverse her view along with the rest of the establishment, I’d like to know why right here.

But before you do, please read some of the common rebuttals to the “Bitcoin will get banned” claims, and my thoughts on each. The points in orange being the rebuttals from arguments first published here.

13 Arguments Bitcoin Bulls Are Wrong On

Which governments would ban Bitcoin? The risks will vary depending on whether you live in North Korea, China, or Switzerland. All countries have borders that can be crossed by people. Bitcoin crosses borders as easily as any information can.

All governments. The only reason the government functions is because of tax, which BTC provides shelter from. Which makes it a target. It doesn’t matter that it can be taken across borders, so can gold, the issue is there’s no easy way (yet) for govts to track it, control it, and tax it, and therefore it’s a threat to the system which revolves around regulating and controlling transactions.

Bitcoin is a global software network that cannot be stopped anymore than we could stop all ants from existing around the globe. Even governments are limited in their effective power.

In 2019 most people believed that it would be impossible for governments all around the world to imprison people in their own homes. But here we are. It will be stopped by people being scared to transact in it… these types of people many freedom advocates call “sheeple”. How rational the reasons are won’t matter. See Covid as evidence. Without transactions / volume / adoption, it’s utility / value diminishes. Humans are involved here. The system might be impossible to stop; people sure as hell aren’t.

Pensions, endowments, insurance companies and corporations own Bitcoin. Governments that have allowed these institutions to own Bitcoin will not be able to make it illegal without impoverishing their voter base. Companies that built on top of Bitcoin, including large financial institutions would be crippled.

Firstly, see the recent ESG mandates for pension funds and the likes. They’re all dropping fossil fuel companies and not “socially responsible” companies from their holdings, because they’re being forced to. These are plain vanilla stocks. If they have managed to do that to stocks, why on earth can’t the same thing happen to Bitcoin? Secondly, governments have been shutting down businesses and impoverishing their voter bases since the start of the virus. This would be no different to what is already happening.

Governments are constrained by their citizens and laws. Since politicians, corporations, and citizens already own Bitcoin, some in “the government” or capable of lobbying the government already have a vested interest in Bitcoin.

In theory governments might be constrained, in reality citizens are constrained. Find one government representative that has any hope of getting into power in any country that is pro Bitcoin and wants to make it legal tender. Show me the chart where most of the population own Bitcoin and are pressing their govt officials to keep it legal. You won’t be able to, because a fraction of the population owns Bitcoin, and no powerful politicians are in public support of it, regardless of whether they own it.

Countries compete with each other, they won’t all work together to stop Bitcoin. Governments want to attract investment and technology so they will create competitive laws to attract Bitcoin. Rival countries need neutral reserve assets like gold or Bitcoin since they cannot trust the currency of their rival.

Seems logical, but check out every major economy’s interest rates since 2008. They’ve all been the same in order to “save the system”, meaning there has been no escape valve. All that work, destroying their economies, and then they’ll magically say BTC is fine? This is why BTC has become so popular as an asset class, and simultaneously what makes it a target. Of course capital would flock to countries who were pro Bitcoin and decentralisation; and so would the rest of the world’s governments – to shut them down… because if they were successful, that’s the end of the system. It’s not in any one government’s interests for btc to succeed. Maybe to dethrone the US, but what then? The nature of government is force and control. Enjoying the spectacle of one’s enemies being destroyed (As China is currently doing with the West) is not the same as being pro freedom. All governments want control. So a mass adoption by competing countries is unlikely to happen.

Peer-to-peer exchanges cannot be stopped. Every country that has shutdown exchanges have seen the emergence of peer-to-peer exchanges that can leverage any existing payment networks.

While the tech cannot be shut down, the majority of people can be shut down. See.. oh I don’t know, all of world history as an example of governments forcing people to do things or not do things for a “greater good”.

Transactions are unstoppable and undetectable. Bitcoin transactions can be hidden in text messages, emjoi, images, and sent from anywhere on the internet.

They’re not unstoppable. You make it illegal to transact in BTC, or you tax it to the high heavens, and watch what will happen. The network will shrink, and become tiny and inefficient. There may be the hardcore users, but it’ll be like the Matrix, except without the happy ending.

Governments can never completely stop goods that most people want. Black markets form in cannabis and alcohol, and Bitcoin is far easier to move and harder to detect than those.

This uses the history of black markets as a standard for BTC. The difference now is that you’re trackable everywhere through all your online activity, even your bloody toaster listens in on you these days and feeds the info to big tech. So. If we’re all under surveillance and the consequences for transacting in BTC are severe, it won’t get to broad acceptance. In summary; it may be far easier to move, but it’s not in practicality harder to detect. For example, in order for you to avoid detection, you’re going to want to use VPNs or Tor or whatever. So say the govt bans them, because they are where terrorists are… The “far right extremists” are all using VPNs, so that threat needs to be eliminated. This is why issues like censorship that I often cover to the shagrin of many peers are so important, because censorship is used to stop things unrelated to speech, like BTC transactions. People don’t make the link between free speech and economic slavery, but it’s there I assure you. Same as shops who accept payments in btc. They’ll be ordered to hand over wallet IDs, and once the govt has that, it’s there for all the future and subject to all future tech and enquiry that can link transactions and when (not if) you get found. Point is, sure, it might be possible to remain undetected, but it’s going to be so hard that people will not bother and just won’t participate.

Governments with property rights laws are mostly treating Bitcoin like other assets. They are incentivized to tax it, not to make it flee across the border.

Bitcoin is not like other assets, which is why it’s actually NOT being treated like other assets. On the one hand, more than a decade after the technology is in play, there are still unclear and ever-changing regulations and classifications in the legal systems and tax codes of the world. On the other, it’s a new asset class that has “hockey sticked” in investment, which has been led by decentralised individuals, and not centralised corporations and investment funds etc. It threatens the SYSTEM, so some countries might go down the tax route, making the taxes a lot higher (and therefore disincentivising people from owning) or outright making it illegal. This is all still unfolding, but believing that individual property rights will be upheld at all costs is optimistic if not outright utopian at this point. Betting on BTC in this regard is like betting against the government. Maybe it happens this time, in which case it’s really the start of an entirely new form of civilisation (exciting), but history does have a habit of rhyming, and the size of the rebellion is nowhere near sufficiently large enough yet.

Bitcoin cannot be confiscated without permission. Bitcoin is pure information that can be stored in your head, spread between people, or moved instantly across the internet. It can be probably transferred out of your control prior to capture.

See Julian Assange or Edward Snowden for an example of what can happen when you procure and share information. Will you want to own Bitcoin if the ramifications of being caught with it are so draconian?

Real estate, stocks, and bonds are far easier and bigger honeypots to confiscate. There is nothing else to own more secure than Bitcoin.

Real estate, stocks and bonds are owned by a far higher percentage of the population, which would make it much more politically difficult to confiscate wealth (which won’t stop them stealing it anyway). We believe that’s likely to happen regardless, over time, but it’s far easier to steal from a smaller % of the general public who believe in privacy and decentralisation, who do not organise. Think about it, you can steal from them and still be in a “democracy” if you can convince everyone else… You know, “those poor saps who lost their jobs from covid, who don’t own Bitcoin, that it’s unfair because those that do are privileged with technology” or some such hogwash. In order to understand how a politician will confiscate your wealth for redistribution, put yourselves in their shoes, apply a bit of creative thinking, and your perspective will change.

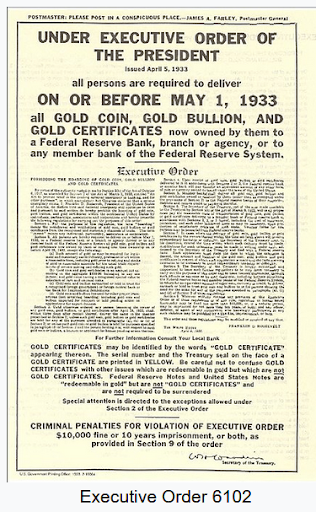

The confiscation of Bitcoin will be rolled out slowly country by country allowing people to adapt. The confiscation of gold only occurred in the US. Gold prices went up in other countries where you could own it.

The entire world’s political and regulatory policies are now being pretty much dictated by intranational, globalist, Davos attending organisations like the EU, UN, IMF, World Bank, Central Banks, WEF, not to mention all the trade partnerships, working hand in hand with large corporations. This isn’t the 1950s. Globalization requires cooperation of the world’s countries, in order for it to work as one system. If countries depart from it, they get isolated and treated as threats to the system as a whole. Our view is we are set for many years of de-globalisation (here’s the whole story), but that doesn’t automatically mean we go back to how the world was before. Nor does it mean countries are going to peel off and become ultra laissez faire capitalist low tax havens that value freedom and personal liberty, without massive struggle/change. So, using historic examples of politics and regulation is erroneous. In terms of the gold confiscation argument… guess what? The vast majority of people handed their gold in. The same thing would happen again.

Central Bank Digital Currency (CBDC) issuance will forever legitimize crypto currencies and this will be a boon for Bitcoin.

This goes hand in hand with the belief that regulation is a good thing as it will legitimize Bitcoin, and that will bring more capital into the space. That would undoubtedly be true, if it were a world of price stability and free market capitalism that the elites have in mind. Absolutely nothing I’m seeing right now indicates that any of the people in positions of power today have the sort of ideology that is free market oriented.

Conclusion

We will at some point sell and instruct our clients to, and hope to do so at a massive gain and before the hammer comes crashing down.

Maybe we succeed, maybe we don’t. Time will tell.

I do think Bitcoin can easily run over $100k, or much more, and we remain long (with adequate risk management and position sizing of course)

…and this comes from a guy who bought my main slug of a position back in 2014 and weathered the volatility since without selling.

Ballsy? Maybe. Time will tell.

If Bitcoin gets to $100k (or something in that region), gold at anything below $5,000 would be a substantially better risk reward trade, in our humble opinion.