While US equity indexes have been relatively stable despite the recent spike in volatility, what is going below the surface is sheer turmoil.

This article was originally published by ZeroHedge.

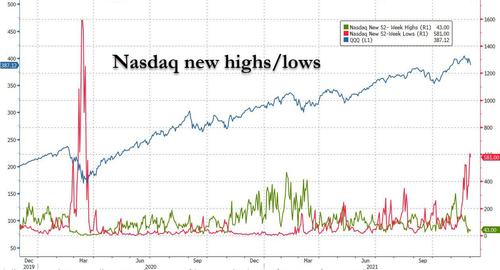

Take the Nasdaq: while the index remains just shy of all time highs, this is entirely thanks to the five or so gigacaps, the GAMMA (fka FAAMG) stocks, which has found solid support in recent days. Alas, the same can not be said for the rest of the tech-heavy Nasdaq where as the chart below shows, we have just seek the biggest spike in new 52-week lows since the March 2020 crash.

This, when coupled with the recent bloodbath observed in the median stock (as measured by the Value Line Geometric), is why yesterday we rhetorically noted that “they better not start selling the generals” or else everything will come crashing down.

So cue SocGen’s in house grizzly bear, Albert Edwards, who – never lacking for a scenario which ends in fire and brimstone – writes this morning that hope is not a strategy and that unfortunately for the bulls, “FAANGs will end up sinking like a BRIC.”

Reminding his readers that Inflation and Covid remain the main focus of the markets (they hardly need reminding in light of the explosion in vol in the past week), Edwards said that he feels compelled “to flag up two important BRIC-related anniversaries that might be relevant for the dominant FAANG stocks.”

First, the SocGen strategist notes that it is the 20th anniversary of the invention of the BRIC acronym. (BRICs, for those who need reminding, was dreamed up by Goldman’s former Chief Economist, Jim (now Lord) O’Neil, who predicted that the emerging economies of Brazil, Russia, India and China would enjoy superior economic growth and investment returns relative to the developed economies. A few days ago Jim O’Neil marked this anniversary with an update in the FT).

Second, it is also exactly the 10th anniversary of Edwards’ note that ridiculed ‘BRICs’ as an investment idea entitled “BRIC = Bloody Ridiculous Investment Concept.”

Back then, Edwards wrote that in an Ice Age world of low nominal growth, “investors are desperate to believe the EM and BRIC growth story, for they have so little alternative. The story of superior growth for the EM universe is as entirely plausible as it is entirely misleading. Valuation is what matters for investing in EM, not their superior growth story and certainly, EM equities are not relatively cheap. Yet investors persist in the BRIC superior growth fantasy. But it is no different from many of the other investment fantasies I have witnessed over the last 25 years only to see them end in severe disappointment.” BRICs have indeed been terrible investments over the past decade, underperforming both MSCI World and even the EAFE index by a very wide margin.

Why does this matter? Because as Edwards urges readers today, they should put a reminder in their calendar to look out for his Global Strategy Weekly on 2 Dec 2031, by which point the SocGen permabear believes that FAAMGs will have gone the way of the BRICs:

I have a similar feeling that in a decade’s time FAANGs (and US tech generally) will go the way of the BRICs as another example of acronym investing going horribly wrong.

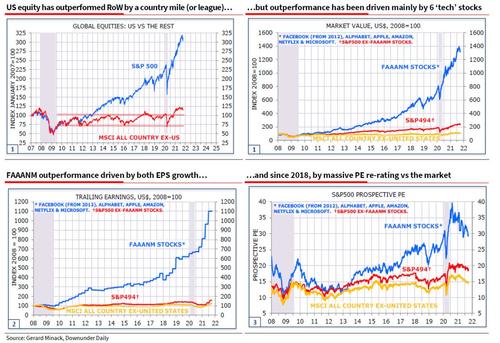

Edwards then points to the following six charts from Gerard Minack (originally written up in this article by John Authers)…

… and notes that a key story in the charts above is that “excluding the 6 ‘gigatech’ stocks, profits growth in the S&P494 stocks has been little different from the RoW. Another is that the FAAANM stocks saw their explosive re-rating only over the past five years.” And while most of the FAAANM 6 stocks are no longer in the tech sector, “they certainly benefited from the explosive tech and growth stock re-rating that occurred around the time of the infamous Powell Pivot at the back end of 2018, as well as from the ‘tech-friendly’ nature of the pandemic recession.”

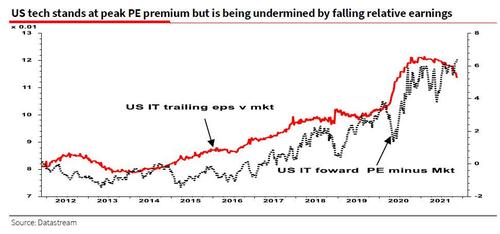

But, as Edwards warned then, “if tech is relying on EPS momentum, the rug may be beginning to be pulled out from under the sector.”

The SocGen strategist picks up on this warning again today, and notes that despite the sharply declining EPS of the broader IT sector, the FAANGs continue to trade at a “nosebleed PE valuation at 30x which looks vulnerable vs the market’s 22x – the widest gap since the Nasdaq bubble.”

It is hardly a surprise then why Edwards’ highest conviction trade is the death of the “generals”, an outcome that would have catastrophic consequences for the entire market.

Albert’s full note which touches on many other topics, is available to pro subscribers in the usual place.