Despite the pandemic apartment construction remained strong during and after the pandemic.

Housing Construction Tops 300,000 Again

This article was originally published by Mish Talk.

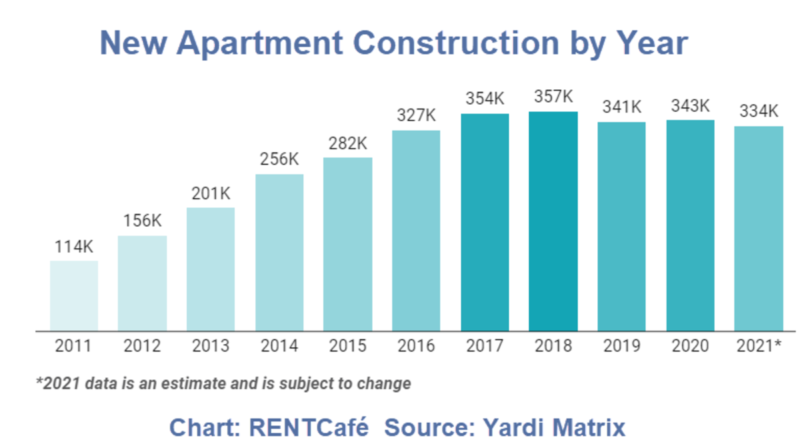

The RentCafe reports Robust Apartment Construction for 6th Year

“The pandemic shifts and resurgence of the residential rental market brings new residential supply into focus,” says Doug Ressler, manager of business intelligence at Yardi Matrix. “Lack of entry-level housing supply and rising home prices will show the multi-family rental market demand increasing as new renters enter the market and Millennials extend their rental commitments.”

“The pandemic shifts and resurgence of the residential rental market brings new residential supply into focus,” says Doug Ressler, manager of business intelligence at Yardi Matrix. “Lack of entry-level housing supply and rising home prices will show the multi-family rental market demand increasing as new renters enter the market and Millennials extend their rental commitments.”

Construction Highlights

- Apartment construction topped 300K for the 6th year in a row

- Developers are set to bring 334,000 new apartments on the market this year.

- 8 metro areas out of top 20 are expected to hit a 5-year high in apartment construction. Among these are 2 newcomers to the top builders’ club – the metro areas of Kansas City, MO (4,967 units), and Raleigh, NC (4,836 units).

- In 2020, 13 metros out of the top 20 experienced decreases in apartment construction. This year, only 6 out of 20 metros are seeing drops.

- The Dallas-Fort Worth metro area is the torchbearer of apartment construction for the 4th year in a row. Renters can rejoice knowing there are 21,173 new units in the pipeline, to be available on the market by year end.

- The New York metro returns to pre-pandemic levels, with 19,375 projected units. The area is expected to see a 11% increase in apartment construction compared to last year.

- Phoenix claims the 3rd spot nationally. A much-needed supply of 15,846 units is on the way.

- Charlotte, NC is witnessing a boom, with a 100% increase in apartment construction over 2020. The projections show 10,723 apartments to be delivered this year.

- Orlando, FL has 78% growth, with projections at 8,211 units.

The NAR Claims There’s a Chronic 5.5 Million Shortage of Houses

I did not buy the NAR’s line then and I certainly don’t today.

Starts and Households Since 2000

- 25,107 Total Starts

- 18,837 Single Family Starts

- 23,341 New Households

There were 25,107 starts and 23,341 new households. Starts were sufficient to cover households.

However, we do not know how many people wanted houses and did not get them. Nor do we know the numbers of houses that were torn down.

Starts and Households Since 2010

- 11,866 Total Starts

- 6,900 Single Family Starts

- 14,760 New Households

Interestingly, since 2010 the US added 14,760 households but only 11,866 new houses.

Given the definition of household, the above numbers may seem impossible.

The apparent conundrum has an easy explanation: There was a pool of existing houses sufficient to accommodate millions of new households.

Underbuild or Overbuild?

Did we underbuild since 2010 or overbuild from 2001 to 2008?

Both? Neither?

Always a Shortage at the Top

Amusingly, the NAR argued in 2007 that there was a shortage of houses. Clearly there wasn’t.

At every market peak, there always appears to be a shortage.

That does not imply this is the peak. Nor does it suggest anything about a shortage.

Why Are Buyers Aggressive?

- Cheap money from the Fed

- Free stimulus money from Congress

- A booming stock market bubble makes everyone feel wealthy

Let’s not confuse a genuine shortage with an artificial shortage due to monetary stimulus by the Fed and free money stimulus from Congress coupled with a booming stock market bubble.

If the Fed was not manipulating rates lower and openly encouraging speculation in assets, I bet the apparent shortage would vanish.

Affordable Housing Fiasco

In reality, there is no shortage, so some state it this way: “There’s a shortage of affordable homes.”

For that problem, please look at the cheap interest rates from the Fed and scores of programs at every level (Federal, State, Local), that encourage ownership.

Every “affordable housing” program for decades has increased demand, driving prices up.

Homes were actually affordable following the housing crash in 2009. Governments and the Fed did everything they could to drive prices back up.

When homes were affordable, neither the Fed, nor the banks, nor local governments were happy.

Hooray, they are all happy now that they can again launch more “affordable housing” programs!

Addendum

Surpluses and shortages can exist locally even if there is enough housing overall.

For example, people constantly move out of Illinois to Texas, Florida, and even Indiana.

But the NAR’s estimate and methodology of lumping it all together concluding a shortage of 5.5 M homes is nonsense. It neglects overbuilding, and most important attitude changes.

Millennials and Zoomers are more prone to be flexible in jobs, moving, and housing than their Boomer parents. The Fed and Congress temporarily suppressed that trend but for how long?

Demographically speaking, a big wave of boomer deaths is on the horizon. That will add to housing supply everywhere, but more so in Florida cities than Austin.

There is not a one size fits all as the NAR tried to do with its self-serving calculation.