It’s all Bitcoin all day in my Twitter feed these days. Quiet are the Tesla bears, the Fed-obsessed, and even the gold bugs. The HODLers are out in full force celebrating Bitcoin’s parabolic, seven-fold resurgence from the ashes of $5,000 (as of the morning of this writing). Frankly, I’m skeptical of Bitcoin. I see it as a speculative tech stock, not digital money. However, I’m not avoiding cryptocurrency. Instead, I’m trying to determine an appropriate position size and strategy consistent with my investment framework.

This article was written by Seth Levine of Real Investment Advice.

I’ve been around the Bitcoin hoop for a while now. I traded a minimal amount in the early days and made no significant gains (in absolute terms). At first, I got drawn into the prospect of decentralized money and banking—the theoretical and practical benefits that cryptocurrencies potentially possess. However, I expected more development 12 years into Bitcoin’s existence. To me, it still more resembles a tech stock in 1999 than a burgeoning currency—all potential; no (meaningful) practicality (yet).

While I’m certainly not the most plugged into the cryptocurrency scene, I do understand it. Given Bitcoin’s high market capitalization ($666 billion as of this writing)—eclipsing that of Walmart, Johnson & Johnson, and all but a handful of blue-chip companies—I’m surprised that Bitcoin still has so little utility in comparison with these household names. Indeed some people are using Bitcoin, but the overwhelming majority appears to be hoarding it in the hope of higher prices.

Value Requires Utility, Even for Money

Value, in my view, requires utility. Thus, “intrinsic value” is illogical. I don’t see how something can have value in and of itself; just because it exists. For an asset to have value, it must have value to someone else, a.k.a. a value-er.

Material objects as such have neither value nor disvalue; they acquire value-significance only in regard to a living being—particularly, in regard to serving or hindering man’s goals.

Ayn Rand, “From the Horse’s Mouth,” Philosophy: Who Needs It

Food, housing, entertainment, art, etc., all serve purposes for the purchasers of such items. Their market prices reflect this value. Remember, oil was a property-devaluing nuisance before 1859. Today, however, the opposite is true. What changed? The invention of oil refining birthed utility to the previously useless sludge transforming it into the black gold we know today.

Money is no different. It serves a human purpose from which it derives its value. Money is a measurement concept for the economic worth. It quantifies value, making it relatable among people and hence facilitates trade. Just like there could be no houses, cars, or smartphones without standards of length (feet, inches, meters) or time (seconds, hours, days), modern economies necessitate monetary standards.

Bitcoin is Not Money (and Probably Never Will Be)

Bulls commonly consider Bitcoin to be the future of money. I don’t see it. Money is simply a unit of account, which is a type of specific measurement used to tally economic value. Money is not synonymous with a medium of exchange or store value. While these functions get denominated in money-terms, they are distinct concepts, in my view. This conflation only breeds confusion.

My delimited—if not uncommon—definition of money highlights Bitcoin’s challenge here. Until you get paid by your employer or buy groceries, in Bitcoin, it won’t serve as a commonplace measurement of economic value. People will mentally convert any Bitcoin transactions into the local monetary standard (dollars, euros, yen, etc.), no matter how splashy the headline.

Panthers’ Russell Okung made Bitcoin headlines by allegedly becoming the first NFL player to be paid in Bitcoin …

However, an actual read of the details reveals that the team is paying him in dollars (i.e., fiat). Half of his salary will be automatically get converted to Bitcoin at the spot rate. Using similar logic, Okung is also getting paid in food, clothing, and cars.

That said, just because Bitcoin is not money doesn’t make it valueless. Its supporters make other reasonable claims which can systematically be analyzed once unpacking Bitcoin from its many slogans. These other use cases are more plausible, in my view, and potentially give Bitcoin its value.

Bitcoin’s Value is All in the Future

When you boil it all down, Bitcoin is fundamentally a database. Its innovation is in how it’s maintained. Bitcoin requires no central authority (i.e., an owner, like a company) to operate like all others. Preferably, the database’s maintenance is a function of the decentralized Bitcoin network (i.e., participants’ ecosystem).

Decentralization carries both benefits and drawbacks, with Bitcoin’s main virtue being its immutability. However, this robust integrity comes with a cost. Updating the Bitcoin database is very slow.

Bitcoin’s database fidelity is as innovative as it is potentially valuable. Satoshi Nakamoto’s vision—Bitcoin’s mythical creator—was for it to serve as a trustless system for electronic transactions, “a purely peer-to-peer version of electronic cash.” In other words, the initial vision of Bitcoin was as a payment platform for transmitting value efficiently and cheaply—i.e., electronic currency. Such differs from today’s systems, which are slow, expensive, cumbersome, and the result of byzantine regulations.

Technology

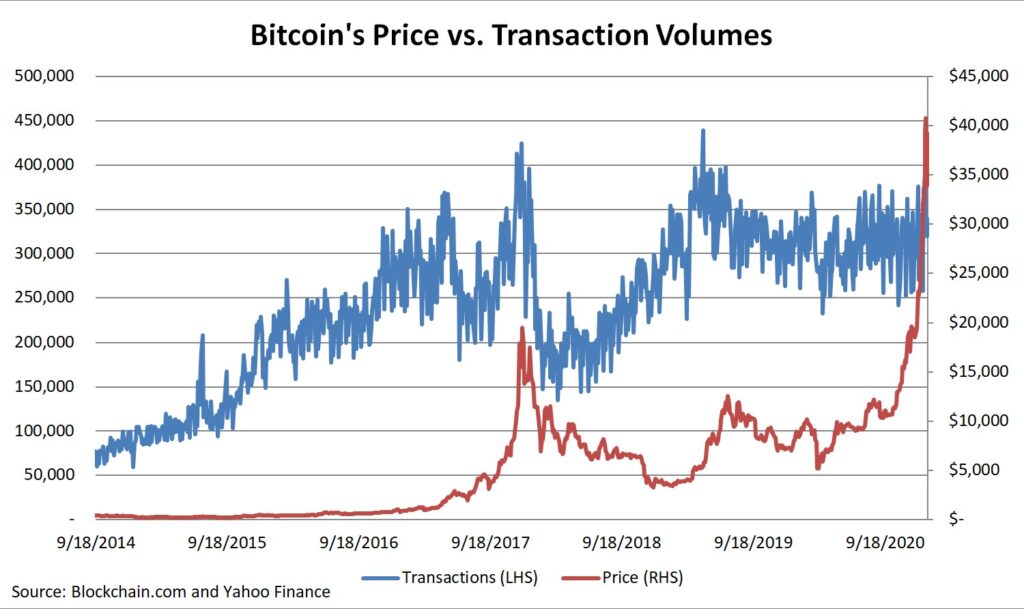

While I find Bitcoin’s technology promising, it’s nonetheless more potential than reality. There’s little evidence that Bitcoin is being used much for anything other than financial speculation. The is a large disconnect between Bitcoin’s price and its use in transactions—its utility. The former has exponentially soared while the latter has stagnated.

Transaction volumes do not seem to impact Bitcoin’s price.

Transaction volumes do not seem to impact Bitcoin’s price.

To be sure, the world is digitizing. However, there’s little evidence that Bitcoin—or any other existing cryptocurrency—is required to effectuate this future. Despite (alleged) hordes of smart people working on cryptocurrency-related projects, there’s presently little use for Bitcoin. Its prospects lie firmly in the future and are far from certain. Thus, while I’m hopeful for Bitcoin’s success and mass adoption, I see it as another “trading sardine” for the time being.

There is the old story about the market craze in sardine trading when the sardines disappeared from their traditional waters in Monterey, California. The commodity traders bid them up and the price of a can of sardines soared. One day a buyer decided to treat himself to an expensive meal and actually opened a can and started eating. He immediately became ill and told the seller the sardines were no good. The seller said, “You don’t understand. These are not eating sardines, they are trading sardines.”

Seth Klarman, Margin of Safety via ValueWalk

My Bitcoin Framework

Calling Bitcoin a trading sardine is no knock. There’s good money to made in its speculation. For me, until I was able to size it up in my framework, I’ve been gun-shy to commit meaningful amounts of capital to it. After all, everyone needs an investment philosophy, whether we know it or not. While I see Bitcoin’s promise, I also see zealots giving me pause.

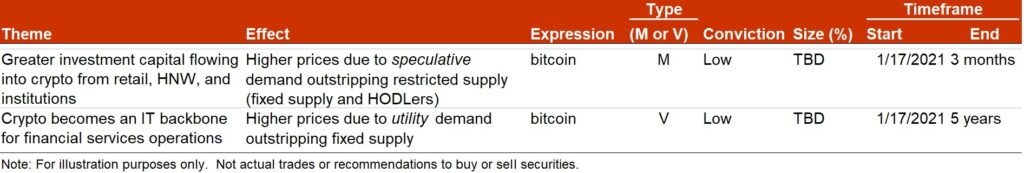

For me, Bitcoin fits into two distinct strategies. The first is purely a momentum trade. I want to trade its trend. Such could be very significant since most investors appear to be accumulating positions with no intention to sell. Thus, the emergence of more and larger players, like institutions, could have outsized price implications on the limited supply of Bitcoin circulating. (The opposite is also true!)

My second strategy is value-oriented. I, too, am enamored by Bitcoin’s potential to transform financial services. If Bitcoin gets adopted en masse, its price would surely rise as use case demand met the fixed supply. However, I have a shallow conviction in this. First, I am skeptical that it will occur given the vast amount of regulation in the space. Furthermore, I’m not convinced that Bitcoin would necessarily emerge as the winner should my capitalist utopia materialize.

The above is an illustration of how I transform my views on Bitcoin into a concrete investment.

The above is an illustration of how I transform my views on Bitcoin into a concrete investment.

Thus, I have a hard time committing significant amounts of capital to either trade. However, I am still able to participate by managing my position size. I’m keeping them small, given my skepticism. Of course, these are my opinions. Others will have different views and different exposures.

Deconstructing Bitcoin into Specific Trades Helps

Bitcoin may be the most emotionally charged investment asset of my career. Its supporters make the proponents of gold, Tesla, or even homeownership look skeptical. While their zeal raises a giant red flag for me, I don’t want to write Bitcoin off either reflexively. Instead, I’m trying to dissect the theses, analyze its prospects, and devise a potential plan for trading it.

I see two potentially different ways in which to profit from Bitcoin. The first is a momentum strategy. I want to follow its trend. The second is a value-based, fundamental view. If Bitcoin can serve as a backbone to a next-generation financial services sector, then demand is sure to rise.

To be sure, I have low conviction in both strategies. However, by isolating these views within my framework, I can now systematically allocate capital towards each with more confidence by scaling my position size to my conviction.

The future is always unknowable. Sizing up financial risks is what investors do best. While emotions provide valuable signals, further analysis can often improve their utility.