Tl;dr: Perhaps most critically when breaking down the FOMC statement – the focus falls on one word: “various”.

Bloomberg concludes that while policymakers stressed their “strong commitment” to reducing inflation, support for a higher rate peak may have been less than universal.

This article was originally published by ZeroHedge.

Hence the dovish lean to a hawkish message from the Minutes

* * *

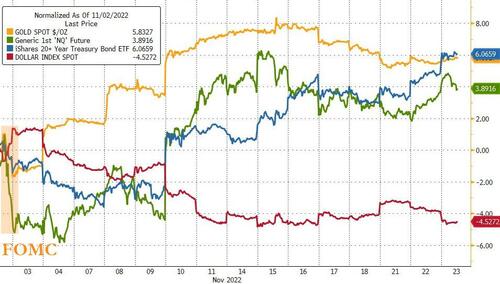

Since The Fed hiked rates by 75bps (for the 4th time) on Nov 2nd, the dollar has been monkeyhammered lower while bonds and bullion have outperformed (along with gains in stocks) as hopes for a pause (the FOMC statement) dominated reality of no pause (Powell and dozens of Fed Speakers since)…

Source: Bloomberg

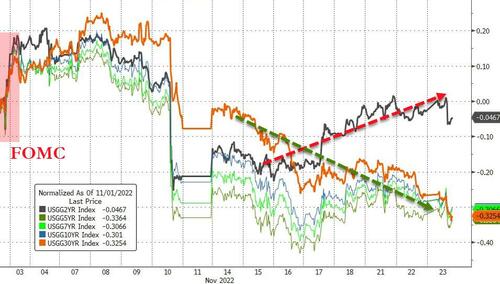

While there has been lots of volatility, the market’s expectation for The Fed’s terminal rate is basically flat while the market’s pricing in a more dovish reaction by The Fed after they have reached the peak and sparked a recession…

Source: Bloomberg

The yield curve has flattened dramatically since the last FOMC statement (inverting ever deeper as recession risks get priced in)…

Source: Bloomberg

So, all eyes will be on the Minutes for any signs of the ‘pivot/pause/slow-down’ that was hinted at in the statement but which Chair Powell destroyed in the press conference. Additionally, the ‘higher for longer’ narrative that has been pushed by numerous Fed Speakers in the last two weeks will be important to pay attention to (i.e if a higher terminal rate than previously thought is needed… and then maintaining that restrictive stance for longer before cutting rates to save the world). Any signals on financial stability anxiety, especially related to QT, will be monitored closely.

The bottom line is that the Minutes will be eyed for commentary on the central bank’s reaction function to both labor and inflation.

Ahead of the Minutes, the market priced a just 12% chance of 75bps at December’s FOMC (100% chance of 50bps), and 63% chance of 50bps in February.

So what do The Minutes Show?

The Doves:

A substantial majority of participants judged that a slowing in the pace of increase would likely soon be appropriate.

Several officials also voiced concerns that “continued rapid policy tightening” would raise risks of financial instability.

The Hawks:

In discussing potential policy actions at upcoming meetings, participants reaffirmed their strong commitment to returning inflation to the Committee’s 2 percent objective, and they continued to anticipate that ongoing increases in the target range for the federal funds rate would be appropriate in order to attain a sufficiently restrictive stance of policy to bring inflation down over time. Many participants commented that there was significant uncertainty about the ultimate level of the federal funds rate needed to achieve the Committee’s goals and that their assessment of that level would depend, in part, on incoming data.

A few other participants noted that, before slowing the pace of policy rate increases, it could be advantageous to wait until the stance of policy was more clearly in restrictive territory and there were more concrete signs that inflation pressures were receding significantly

With monetary policy approaching a ‘sufficiently restrictive’ level, participants emphasised final destination of Fed funds rate had become more important than pace.

Even so, various participants noted that, with inflation showing little sign thus far of abating, and with supply and demand imbalances in the economy persisting, their assessment of the ultimate level of the federal funds rate that would be necessary to achieve the Committee’s goals was somewhat higher than they had previously expected.

On inflation:

Participants concurred there were very few signs of inflation pressures abating.

In light of the continuing broad-based and unacceptably high level of inflation and upside risks to the inflation outlook, participants remarked that purposefully moving to a more restrictive policy stance was consistent with risk-management considerations.

This was before the big drops in CPI/PPI and so this will likely shift dramatically in the next FOMC statement.

On being clueless about the economy:

Participants generally noted that the uncertainty associated with their economic outlooks was high and that the risks to the inflation outlook remained tilted to the upside…. Participants observed that recent inflation had been higher and more persistent than anticipated.

On market stability:

A few participants commented that slowing the pace of increase could reduce the risk of instability in the financial system.

Fed officials discussed turmoil in the UK government bond market, and while they judged that the market for US Treasuries remained “orderly,” a few participants suggested the Fed should be prepared to address any US market functioning issues in ways that “would not affect the stance of monetary policy, especially during episodes of monetary policy tightening”

On the labor market:

Participants observed labor market remained tight; many noted tentative signs it might be moving slowly toward better balance of supply and demand.

On the dreaded wage-price spiral:

few participants commented that the ongoing tightness in the labor market could lead to an emergence of a wage–price spiral, even though one had not yet developed

Interactive Brokers’ Chief Strategist Steve Sosnick says:

“With pivot off the table, and with no pause coming yet, slower pacing seems to be enough for stock traders now.”

* * *

Read the full Minutes below: