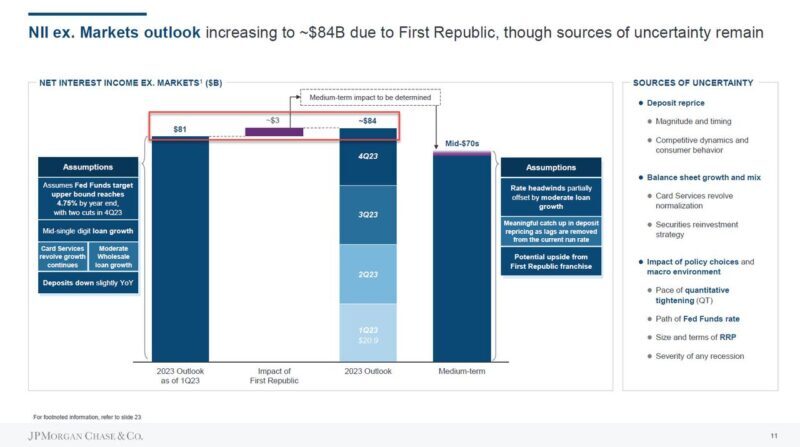

Earlier this week, JPMorgan confirmed cynical observations that it was almost as if the regional bank crisis was designed to make JPMorgan bigger and billionaire CEO Jamie Dimon even richer, when the bank reveled during its investor day that the failure of First Republic Bank would boost JPM’s top line – in this case the Net Interest Income – by at least 3 billion, as the bank generously accepted the bulk of FRC’s viable loans while the FDIC was stuck holding on to the toxic (and worthless) leftovers.

This article was originally published by ZeroHedge.

But while JPM was more than happy to accept the free gift of FRC’s loan book, it was far less excited about inheriting the expense side of the ledger, and sure enough, less than a month after JPM “acquired” First Republic (at a risk-free IRR of 20%+) with US taxpayer funding, JPMorgan has notified 1,000 First Republic Bank employees that they aren’t being given jobs — even temporarily — following its takeover of the failed lender.

According to Bloomberg, the biggest US bank on Thursday offered full-time or transitional roles to 85% of the nearly 7,000 employees still working at First Republic when it collapsed, while the rest were told they wouldn’t get offers. Those getting temporary offers would be offered jobs for three, six, nine or 12 months, depending on the position.

“Since our acquisition of First Republic on May 1, we’ve been transparent with their employees and kept our promise to update them on their employment status within 30 days,” a spokesperson for New York-based JPMorgan said in a statement. “We recognize that they have been under stress and uncertainty since March and hope that today will bring clarity and closure.”

First Republic employees who weren’t offered jobs at JPMorgan “will receive pay and benefits covering 60 days and will be offered a package that includes an additional lump-sum payment and continuing benefits coverage,” the spokesperson said; it wasn’t clear if the FDIC would be footing those costs as well.

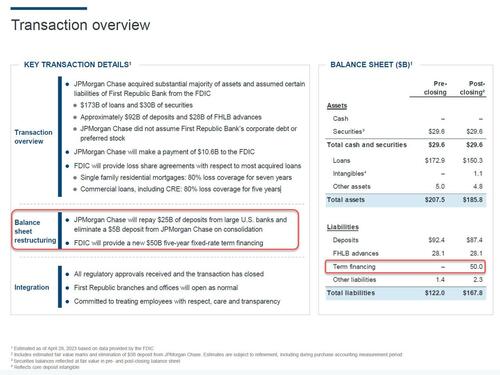

JPMorgan, which has 296,877 employees, beat out rivals in a “government-led auction” for First Republic, which was just another fund transfer from taxpayers to JPM, and which immediately boosted the company’s top line by $3 billion. As part of its winning bid, JPMorgan “acquired” about $173 billion of First Republic’s best loans, $30 billion of securities and $92 billion in deposits, not to mention a peculiar, little $50 billion “term-financing” from the FDIC whose terms nobody has yet disclosed …

… and would then then decide what to do about its employees, dozens of whom had been paid more than $10 million a year, Bloomberg News reported earlier Thursday; needless to say, all those highly paid FRC bankers are now among the ranks of the unemployed, as JPM no longer needs the now defunct loan origination platform, and instead it will simply milk the existing loan portfolio for the next decade or so.