Lumber Bubble Bursts; Term Structure Slope Suggests Relief Coming For Homebuilders

Earlier this month, we told readers, “Lumber Prices Slump As Historic Boom Hits A Wall,” as sawmills were catching up with the flurry of demand from North American homebuilders amid supply chain issues, which created massive supply constraints, which propelled lumber prices to record highs.

This article was originally published by ZeroHedge.com.

Ole Hansen, Saxo Bank’s chief commodity strategist, said the plunge in lumber prices might spiral down some more as speculators exit their positions and supply catches up with demand.

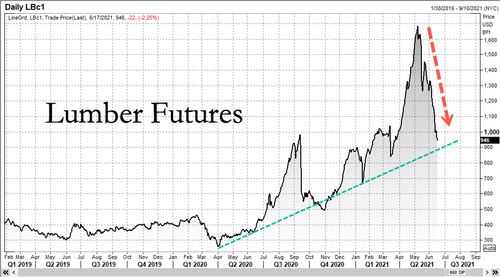

Lumber futures on Chicago Mercantile Exchange are down more than 2% on Thursday. Prices have fallen 44% since May’s record high of over $1,700 per thousand board feet, although prices remain 282% higher than the lows seen in early 2020.

The chart below of lumber prices appears to be a classic “commodity blowoff top.”

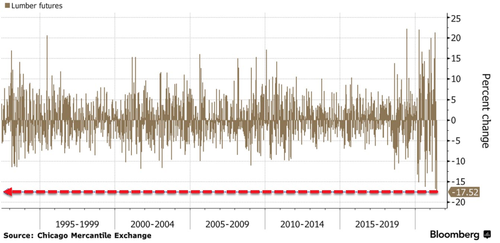

Last week, lumber futures fell 18% in the most significant weekly decline since 1986, one year before the 1987 stock market crash.

Hansen said there was are several factors that suggest prices may fall further.

“Something like lumber has been very much a pandemic-driven spike,” he told Bussiness Insider, adding that sawmill capacity wasn’t able to keep up with supply as “people went crazy in their backyards, redoing their houses or buying a bigger house” that caused prices to soar.

In addition to the physical market, speculators such as hedge funds are puking their long positions as prices continue to waterfall, he added.

“Some of that activity is bound to slow [and] supply is starting to meet the demand,” he noted.

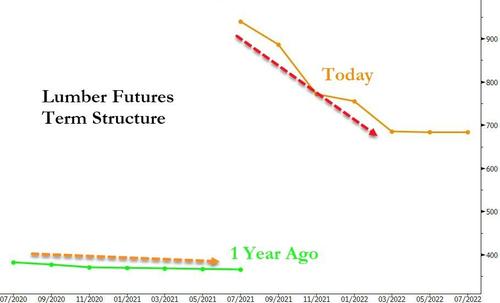

Hansen pointed out the curve for lumber futures is sloping downwards and suggests that “the market is looking for quite some weakness as we head into the autumn and winter months.”

Weakness in lumber prices in the second half could offer relief for homebuilders who’ve been stunned by skyrocketing costs. This week’s latest housing report showed May permits plunged to the lowest level since October. The chart below suggest surging costs are halting new construction.

Besides homebuilders, home buying intentions among consumers are at the lowest in two decades as lumber and other costs push housing prices to unaffordable levels.

After the multi-day Federal Open Market Committee meeting, Fed chair Jerome Powell briefed reporters Wednesday and said inflation would prove to be temporary.

“The thought is that prices like that, that have moved up really quickly because of shortages and bottlenecks and the like, they should stop going up. And at some point, they, in some cases, should actually go down. And we did see that in the case of lumber,” Powell said.

However, even as lumber prices correct from stratospheric highs, BMO Capital Markets warns that prices may not return to pre-pandemic levels any time soon.