The National Association of Realtors (NAR) estimates millions of Americans have been priced out of the housing market since January as sky-rocketing mortgage rates spark an affordability crisis.

This article was originally published by ZeroHedge.

Nadia Evangelou, a senior economist and head of forecasting at NAR, said 9 million homebuyers had been priced out of the market. Out of that total, about 3 million millennials.

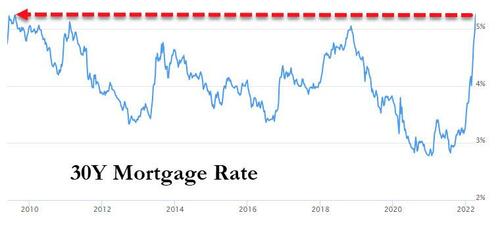

The blame resides primarily on soaring mortgage costs as the 30-year fixed-rate average jumped from about 3% at the start of the year to a shocking 5.25% this morning – the highest since 2009…

Evangelou warned affordability has plunged through the virus pandemic as housing prices increased faster than incomes. Now mortgage costs are climbing as home prices remain at all-time-highs, pricing people out of the market.

As discussed in March, “Housing Affordability Is About To Crash The Most On Record“ and “Biggest Housing Affordability Shock In History Incoming,” the affordability crisis is already cooling the red-hot housing market.

NAR points out that the monthly cost of paying off the median mortgage in California has jumped more than $500 since the start of the year. Wage increases minus inflation is negative and are another reason for the affordability crisis.

Actuarial accountant Rachel Linehan told Bussiness Insider that soaring rates slashed their homebuying budget by $100k and has forced them to look at houses in undesirable areas.

“It’s pretty demoralizing. We went in feeling pretty hopeful but that hope has diminished over time to the point where we are feeling pretty small.

“We’re getting to the point where we might give up soon,” Linehan said.

Evangelou points out that housing affordability is some of the worst on record. Similarly, BofA economist Alex Lin recently showed clients the plunge in affordability is at a record pace.

NAR suggests the affordability crisis is likely to worsen. Last week, we outlined that housing market cracks have begun to appear as sellers drop their listing prices.