The ‘buy now, pay later’ (BNPL) craze is sweeping across America as debt-ridden consumers tap another credit lifeline that has propelled record sales for Black Friday and Cyber Monday. This trend has become another financial crutch for consumers hooked on spending beyond their means.

This article was originally published by ZeroHedge.

Data from Adobe Analytics showed that more Americans than ever relied on short-term loans, allowing installments over weeks and/or months for purchase items on Cyber Monday.

Online consumer spending skyrocketed 9.6% from $11.3 billion yesterday, surpassing Adobe’s initial expectations of a 6.1% increase to around $12 billion.

The report noted consumers purchased over $940 million worth of goods through BNPL services. This was a 42.5% jump compared to figures last year and far exceeded Adobe’s earlier estimate of 18.8%.

“The 2023 holiday shopping season began with a lot of uncertainty … The record online spending across Cyber Week, however, shows the impact that discounts can have on consumer demand, especially with quality products that drove a lot of impulse shopping,” Vivek Pandya, lead analyst at Adobe Digital Insights, said, who was quoted by Reuters.

For the five days, from Thanksgiving Day to Black Friday to Cyber Monday, internet sales topped $38 billion, exceeding Adobe’s forecast of $37.2 billion.

We first noted the emergence of the BNPL craze on Monday while referring to record online Black Friday sales of $9.8 billion. It was pointed out that BNPL is popular because consumers are balancing other debt, such as student loans or credit cards, amid the highest interest rates in a generation. These short-term loans allow consumers to make installments over a short period.

According to the Federal Reserve Bank of New York, younger consumers struggling with access to credit cards are frequently turning to buy-now, pay-later options.

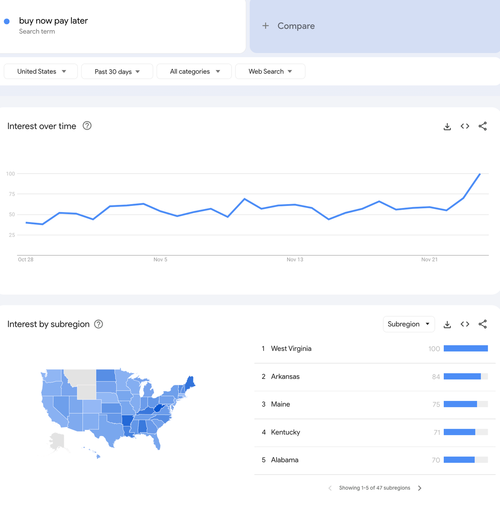

Over the past 30 days, “buy now pay later” Google searches soared beginning last Thursday

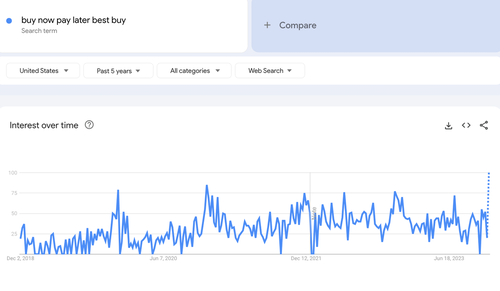

Google searches for “buy now pay later Best Buy” also erupted to the highest level in at least five years.

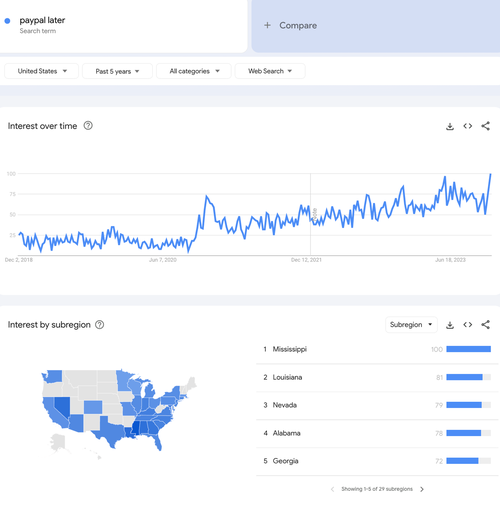

Also, searches for PayPal’s BNPL service rocketed to five-year highs.

News of struggling consumers resorting to BNPL services led Jefferies to upgrade Affirm to hold from underperforming, citing the rapid adoption of BNPL services. Also there have been signs wealthy Americans are cutting back on spending…

The rise in BNPL services should not be a cause for celebration for surging holiday sales, but instead signals a worrying trend in the financial health of consumers, deteriorating quickly under the era of failed ‘Bidenomics.’

We asked the question: Is The American Consumer Tapped Out?