Tales of Cobras, Windows, and Economic Promise

The heart of him who has understanding seeks knowledge, but the mouths of fools feed on folly. Proverbs 15:14

The term “cobra effect” is used when an attempted solution to a problem worsens the problem by unleashing unintended consequences. The name derives from a tale originating in Delhi, India. The government’s concern about rampant venomous cobras prompted them to offer a bounty for each dead snake. Although the strategy initially worked well, citizens began to breed cobras for income. When the government discovered what people were doing, they ended the bounty program. The cobra breeders, with worthless venomous snakes on their hands, set them free. Despite the best intentions, the solution made Delhi’s cobra problem worse.

As you might by now have figured, the cobra effect surrounds us in politics and economics.

This article was originally written by Lance Roberts.

A special thank you to Sahil Bloom (@sahilbloom) for his Twitter thread that inspired us to expand on his thoughts.

Bastiat’s Brilliance

Nineteenth-century French economist Frederic Bastiat has a well-known theory about unintended consequences. He uses a parable to explain that which is seen and what is not seen. His lesson starts with a stone that shatters a shopkeeper’s window. Most noticeable to the town’s people is the economic benefit of the broken window. In their minds, the shopkeeper must buy a window and employ a glazier to install it. As an aside, many economists peddle similar logic in the aftermath of natural disasters.

Bastiat’s brilliance is pointing out the not so obvious opportunity cost of the broken window. In this case, after paying to fix the window, the shopkeeper has less money to spend elsewhere. The shopkeeper could have bought new equipment making his shop more productive and profitable. The benefits of which would have had a positive impact on the shopkeeper’s wealth but also the economy and the populace.

Instead, replacing the window is at best a neutral economic event. There is undoubtedly no net economic gain, but there is an opportunity cost. Financial and material resources were used in a non-productive manner.

With cobras and broken windows in mind, we look at the Federal Reserve’s long-standing monetary policies.

Federal Reserve

Based on their actions over the past several decades, the Fed has increasingly taken more latitude in its mandate. They rationalize these actions through a variety of speeches, editorials, and white papers. Over the years, they have redefined their job from an entity intended only to supplement our capitalist free-market economy to an actively interventionist player.

The Federal Reserve Act, governing monetary policy, does not give them that authority. It simply reads:

The Board of Governors of the Federal Reserve System and the Federal Open Market Committee shall maintain long run growth of the monetary and credit aggregates commensurate with the economy’s long run potential to increase production, so as to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates.

Legislators responsible for oversight of the Fed have not only failed to hold the Fed accountable but abet them in their mission creep. Although their power is supposed to be strictly limited to monetary policy actions, many of the tools they now employ spill over into the realm of fiscal policy. Such activities clearly jeopardize their independence and, therefore, their integrity.

Federal Reserve Snake Oil

The Fed has long led us to believe that lower interest rates produce economic growth and prosperity. Given that interest rates are a “price”, the price of money, the Fed is essentially manipulating that price in U.S. dollar terms. It is also understood that the U.S. dollar is the world’s reserve currency, which affects roughly 60% of all global transactions. That logic can only mean that the Fed is engaged in the single biggest price control scheme in human history. We are not aware of any instances where centrally planned price control efforts have produced favorable outcomes.

As we observe rising levels of geopolitical tensions, wealth and income divergence, and civil unrest, it should be evident the cobra effect is in play.

People, corporations, and governments tend to borrow and spend more when the cost of money is lower. Additionally, lower savings rates dis-incentivizes savings and thus increases consumption. The applied logic is that lower rates produce more economic activity. That is at least how the Fed and most Ph.D. economists prefer we think about low interest rates.

Behind The Fed’s Curtain

Now let’s look behind the curtain at the unseen. Artificially low interest rates encourage the use of debt. Debt is used to pull consumption forward. Therefore, the not so obvious consequence of lower than appropriate rates is weaker economic activity in the future. Artificially low interest rates also inspire non-productive uses of capital and speculation instead of productivity-enhancing savings and investment. Those effects are not apparent at first because low interest rates are initially stimulative. However, as described above, the long-run outcome will be a weaker economy.

That is precisely what we see in the U.S. and among all developed economies. Simply, we are breaking windows today and replacing them.

Under such a scheme, debts grow more than income. Over time, if not allowed to correct, the problem becomes self-reinforcing. Ever lower interest rates accommodate more debt used to pull consumption forward and service the prior debt load. The best way to describe this situation is that monetary policy has become a euphemism for Ponzi.

The Consequences

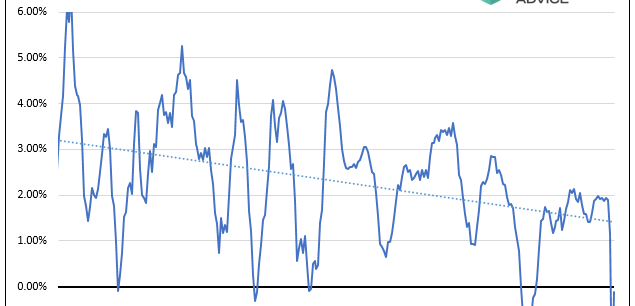

Today we find ourselves with shattered glass and cobras everywhere. U.S. interest rates are at 300-year lows and the zero bound. They are negative in many other parts of the world. The natural economic growth rate is below 2% and has been in decline for decades. Meanwhile, economic orthodoxy insists that the broken glass is a clear sign of a healthy economy, and the cobras will make fine pets. As described in a previous article, this is the very definition of being “gaslit.”

Our claim that Fed policy detracts from future economic growth is easy to support with data. If low interest rates helped the economy, the debt would decline as a percentage of economic activity. Productive debt creates more income than the cost of servicing it and paying it off. As a result, GDP would grow faster than debt. It has not, as shown below.

Further supporting our case is the fact that each economic expansion has been weaker than the previous one.

Bill Dudley

Bill Dudley, ex-President of the New York Federal Reserve, had some comments in a recent WSJ editorial worth repeating. We advise reading the entire article, The Federal Reserve is really running out of firepower.

Moreover, the stimulus provided by lower interest rates inevitably wears off. Cutting interest rates boosts the economy by bringing future activity into the present: Easy money encourages people to buy houses and appliances now rather than later. But when the future arrives, that activity is missing. The only way to keep things going is to lower interest rates further — until, that is, they hit their lower bound, which in the U.S. is zero.

When interest rates stay low for long enough, the policy can even become counterproductive. In the U.S., monetary stimulus has already pushed bond and stock prices to such high levels that future returns will necessarily be lower.

No central bank wants to admit that it’s out of firepower. Unfortunately, the U.S. Federal Reserve is very near that point.

Summary

Replacing broken windows may make us feel good today, but it comes at a cost tomorrow.

Today, the United States faces a $3.1 trillion annual deficit supported with interest rates at or near zero. The Fed and government are rapidly exhausting their arsenal to fight current and future recessions. Equally troubling, almost all of their actions pay little or no future benefit, but the costs stay with us.

Current policies are about expediency. For at least the past 20 years, there are rarely any serious discussions by the Fed or politicians on their policies’ costs. Ignoring the possibility of negative consequences is just another definition of foolishness.

It is worth reiterating a point we have made in the past. The cost is not just financial. Equally important is America’s fraying social fabric as Fed-induced economic inequality bears down on the country.