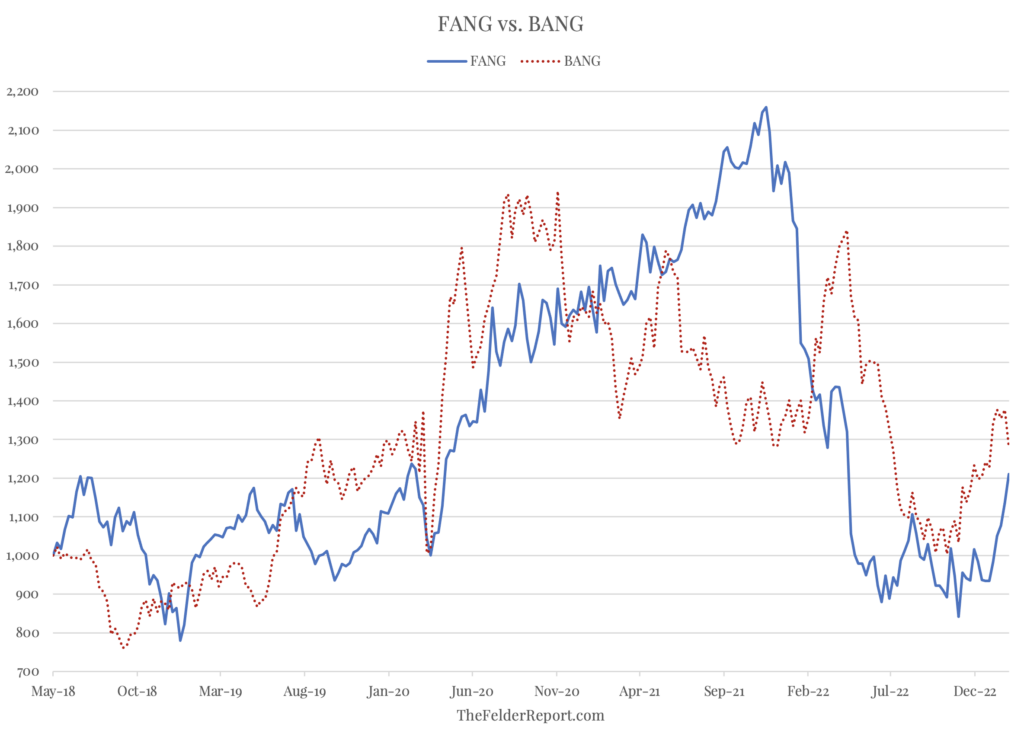

Almost five years ago I wrote a blog post titled, “BANG: Why The Gold Miners Could Soon Make FANG Look Tame.” A reader recently reached out to ask if I would post an update so here it is. The chart below plots two custom indexes: FANG (META, AMZN, NFLX, GOOG) versus BANG (GOLD, AEM, NEM). Clearly, there has been some back and forth between the two with the BANG stocks taking the lead and holding it over the past year or so. Frankly, I’m surprised they haven’t done better but more on that in a bit. As for the FANG stocks, it’s pretty remarkable to see them generate essentially zero return as a group since mid-2018, even after their strong runup to start the year.

This article was originally published by The Felder Report.

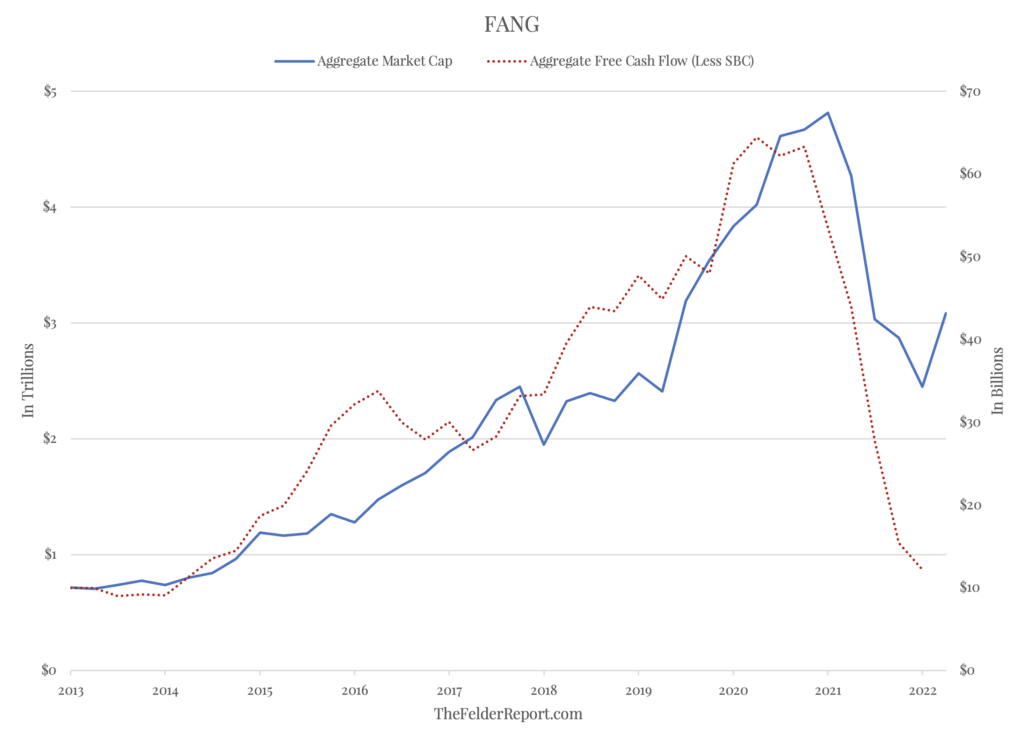

What has driven the poor performance in these perennial stock market favorites prior to this year is the fact that their aggregate free cash flow has fallen more than 80% from its peak a couple of years ago back to a level not seen in almost a decade. This compares to just a 35% decline in their aggregate market cap. Clearly, investors piling into these stocks today are betting the companies can make the transition from hyper-growth to hyper-efficiency and rapidly reverse this plunge in profitability.

What has driven the poor performance in these perennial stock market favorites prior to this year is the fact that their aggregate free cash flow has fallen more than 80% from its peak a couple of years ago back to a level not seen in almost a decade. This compares to just a 35% decline in their aggregate market cap. Clearly, investors piling into these stocks today are betting the companies can make the transition from hyper-growth to hyper-efficiency and rapidly reverse this plunge in profitability.

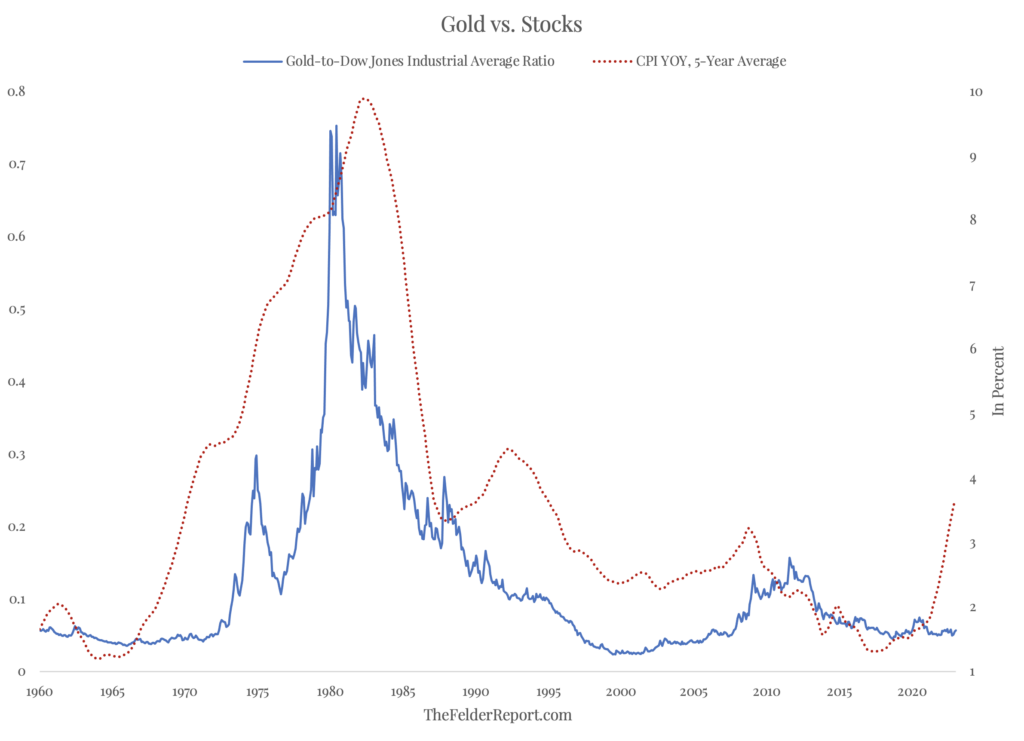

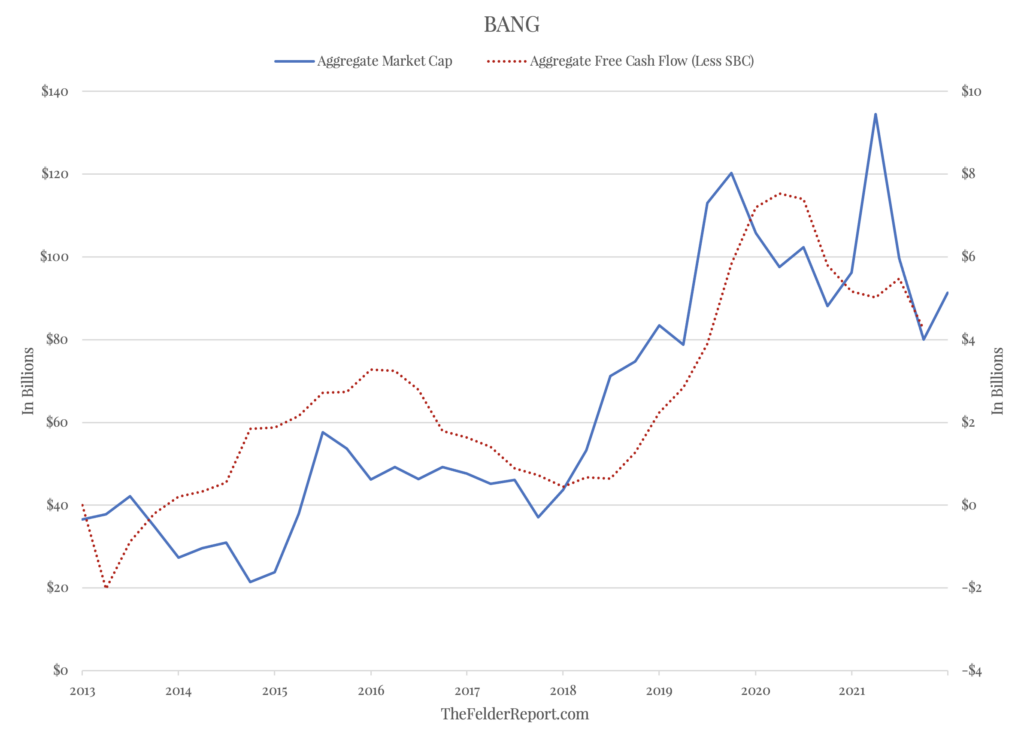

The situation for the BANG stocks, still broadly ignored by investors, is very different. Free cash flow has soared more than four-fold since I first wrote about them. The rise in aggregate market cap has been far less. The result of all of this is that the BANG stocks have outperformed the FANG stocks even while they have gotten significantly cheaper and the latter have gotten significantly more expensive relative to their respective trends in free cash flow. It’s probably important to note, though, that the major driver of both free cash flow trends and valuations for all of these stocks going forward will be the direction of inflation. If the return of inflation proves to be secular rather than cyclical, BANG stocks’ recent outperformance is likely only the beginning of a much bigger trend. Investors, however, still appear to be betting on the idea that inflation is merely a cyclical phenomenon. Time will tell.

It’s probably important to note, though, that the major driver of both free cash flow trends and valuations for all of these stocks going forward will be the direction of inflation. If the return of inflation proves to be secular rather than cyclical, BANG stocks’ recent outperformance is likely only the beginning of a much bigger trend. Investors, however, still appear to be betting on the idea that inflation is merely a cyclical phenomenon. Time will tell.