Last week the Visual Capitalist published another one of their infographics, this time about the oil reserves of different nations. As usual, they make nice-looking graphics, but this document yet again perpetuates the seemingly immortal myth about the magical, inexhaustible Saudi oil reserves which, says the Visual Capitalist, amount to 291 billion barrels. They got those figures from the 2020 BP Statistical Review of World Energy: it is just one of those things that almost everybody knows and which any respectable media outlet is happy to regurgitate without question. It is the familiar truth that almost everybody knows – and almost everybody is wrong.

This article was originally published by iSystem-tf.com.

When I started working as an oil market analyst in 1996, Saudi oil reserves were pegged at 260 billion barrels – 31 billion barrels lower than they are today. In spite of the fact that the kingdom produces about 3 billion barrels each year, these reserves never showed the corresponding decline; to the contrary, with time they only grew.

The industry usually justifies them as a result of technological innovations which have supposedly improved the efficacy of oil extraction. But when the Peak Oil Hypothesis became a thing again in 2006 I made an effort to disentangle the mystery of Saudi reserves.

The last independent audit

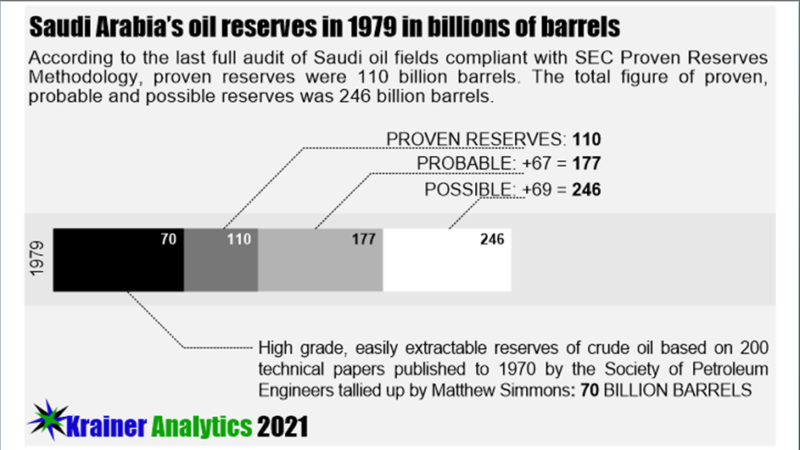

Here is what we know: the last time Saudi oil reserves were officially audited in accordance with the so-called “Proven Reserves Method” as required by the U.S. Securities and Exchange Commission was in 1979. Based on that audit, Saudi Aramco’s managers reported to US Senate investigators that the kingdom had 110 billion barrels of proven oil reserves, another 67 billion barrels of probable reserves and 69 billion barrels of possible reserves.

Oil reserves are classified as proven if there is 90% confidence of them being recoverable with existing technology and under current economic and political conditions. They are probable if there’s a 50% confidence of them being recoverable. For possible reserves, there has to be at least 10% confidence that they can be recovered under existing circumstances and with the currently available technology. In sum, the total of proven, probable and possible reserves in 1979 was estimated at 246 billion barrels.

The magical inexhaustible 260 billion barrels

In 1980, Saudi oil giant Aramco passed from American management to Saudi Petroleum Ministry control and from that date no further independent audits of Saudi reserves were conducted. By 1989, the “conservative” estimates of Saudi oil reserves jumped from the 170 billion barrels officially reported in 1987 to 260 billion barrels even though no significant new fields were discovered (apart from the relatively small Hawath field, discovered in 1989).

This figure – 260 billion barrels has been reported over the following 30 years, frozen in time, even though it is highly problematic on at least two counts. First, since 1982 the Saudis have withheld their well data and detailed information on their reserves so there is no way to independently verify Saudi claims. Second, Saudi Arabia has already extracted more than 123 billion barrels since 1979,[1] implying that its reserves of high-grade, easy oil could be entirely depleted. In spite of all this, in 2018 Saudi reserves jumped again, this time close to 300 billion barrels. We’ll address the sources of this bonanza a bit later. Meanwhile information from several independent sources confirmed the concerns that all is not well below the Arabian sands.

Confidential U.S. Embassy cables from Riyadh[2] exposed by Wikileaks largely supported the suspicions about Saudi Arabia’s reserves and production. A cable from 2007 recapitulates U.S. Consul General’s meeting with Mr. Sadad al-Husseini, Aramco’s Executive Vice President for Exploration from 1992 to 2004. According to that cable, Mr. Husseini asserted that in 2007, Saudi Arabia had 64 billion – not 260 billion – barrels of remaining oil reserves, and that these reserves would last until about 2021 (that’s today, folks), after which Saudi output would enter a period of steady decline that no amount of effort could stop.[3]

According to the same diplomatic cables, in 2007 Mr. Husseini also pointed out that Saudi Aramco planned to increase production to 12.5 million barrels per day by 2009. In spite of a massive $50 billion investment in expanding production, Aramco never came close to their 12.5 mb/d objective. All this received further corroboration in a 2012 report by Citigroup,[4] which concluded that failing to discover major new oil fields, Saudi Arabia might cease to export oil altogether by 2030 – less than 9 years from now!

Linguistic innovations driving the oil bonanza

Thus, multiple official sources all suggest that Saudi Arabia is facing mounting challenges in maintaining oil production and that her oil reserves are nearing the point of exhaustion. In the meantime, as nobody in the financial press seems inclined to seriously challenge their claims, Saudi officials ventured to make bolder and bolder boasts about the kingdom’s oil wealth. In his 2005 book, “Twilight in the Desert,” Matthew Simmons quotes senior management of Saudi Aramco and Saudi Petroleum Ministry claiming: “we can produce 10 million, 12 million, or 15 million barrels a day for 50 to 100 years. … [To] our 260 billion barrels of proven reserves… we can easily add another 200 billion, and we can still add another 200 billion we have yet to discover.” By 2014, they alleged that the kingdom had 790 billion barrels of oil resource and that this figure should grow to 900 billion Barrels by 2025.[5]

Such claims should prove confounding to casual observers or even policy makers who give them credence. The financial press doesn’t tend to help matters by habitually loose reporting of facts and even looser use of terminology. For instance, they make very cavalier use of the word “proven” as did the BP report behind Visual Capitalist’s latest sexy graphic. They also typically use the terms “reserves” and “resources” interchangeably, as if they referred to the same thing. It is however, critical to discern between the two.

The term “resources” comprises oil from contingent and prospective sources including quantities that are potentially recoverable from accumulations that are as of yet undiscovered. Let’s stop and think about that one: oil resources include quantities from as of yet undiscovered deposits!? In other words, we’re analyzing the world’s largest and strategically most significant market based on figures that are by their very definition wide open to exaggeration and wishful thinking. Furthermore, the very term “recoverable,” or “potentially recoverable” is problematic. This is not the same as feasibly or economically recoverable which would imply that the value of extracted oil should cover the costs of exploration, drilling, extraction, transportation and a certain return on invested capital. What we have traditionally understood as “reserves,” usually represents only a small fraction of resources that can be feasibly developed.

Incidentally, oil reserve figures presented by Oxford University’s website OUR WORLD IN DATA hit much closer to reality. They say that in twenty-nineteen, Saudi Arabia had only 40.88 billion barrels of oil reserves!

You might wonder how Oxford arrived at that figure, but if you guessed that they did so through more diligent research, you’d be wrong. Like almost everyone else, Oxford relied on the same BP’s statistics, except they reported METRIC TONS as BARRELS. That misrepresented BPs figures by a factor of 7.3 – a shocking fail for such a respected institution of higher learning. This should be a stark warning for us to always be very careful with the information we consider because much of it will prove to be outright junk, even if it is published by respectable institutions.

The revelation from Aramco’s 2019 bond prospectus

On April 1, 2019 Saudi Aramco published a bond prospectus in which they disclosed that their largest oil field, Ghawar is producing 3.8 mb/d and not 5.8 mb/d as everyone previously “knew.”[6]

Two million barrels per day vanished without any explanation. Given that Ghawar supposedly accounted for about half of the kingdom’s production, supplying more than 5% of global oil demand, this was a rather staggering revelation. But the financial industry and the media made little mention of this and the markets entirely shrugged it. Eventually however, the reality will inevitably catch up and humanity will inevitably be facing a severe and irreversible energy crisis. While this article focused on Saudi oil reserves, it is clear that oil reserves have been falsely inflated by all OPEC nations as their export quotas are based on those official reserves. It is unfortunate that the only people planning for the energy crisis are our top-down central planners whose medicine will almost certainly prove worse than the disease.

Rather than allowing the markets to work out viable alternatives, their chosen path forward is to defund hydrocarbon energy and force the world economies toward ‘sustainable’ energy sources. If oil becomes scarce, prices will rise and the people and economies will adjust: they’ll carpool, make greater use of public transport, travel less, switch to bicycles, etc. Longer term, the architecture of our societies can be modified favoring more traditionally organized cities instead of suburban sprawl. And with today’s broadly distributed knowledge, technological tools and ability to collaborate across the world, we could dare be optimistic about new, viable solutions to our energy requirements. But such bottom-up solutions could prove difficult to control for those for whom top-down control is the overriding concern defining their agenda for the future of humanity.

Speaking of higher prices…

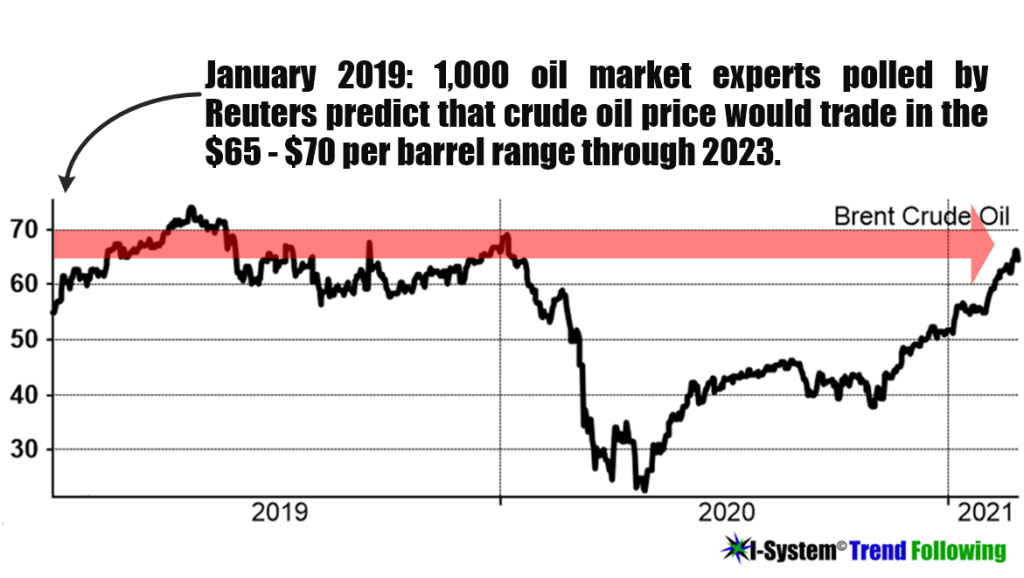

There’s another important aspect to the economic fundamentals of the oil markets that I laid out above: virtually all of it was known and discernible two years ago, with the same implications: that we’ll almost certainly be facing a severe energy crisis in the near future and that the prices of oil would go much, much higher. But consider what happened in the two years since? In spite of these very bullish long-term prospects, the oil price collapsed by nearly 80% last year, the development that nobody could have predicted.

Indeed, markets are unpredictable but as experience has taught us, these large-scale price events always span a period of time counting in months and years, and unfold as trends. This is why over the long haul, systematic trend following is the only reliable solution to the problem of uncertainty.