THE GREAT COMMODITIES BULL MARKET: GOOD THINGS TAKE TIME

The latest report from Marathon Resource Advisors on the state of the commodities market is well written and really easy to understand, and we highly recommend you read it.

This article was originally published by Capitalist Exploits.

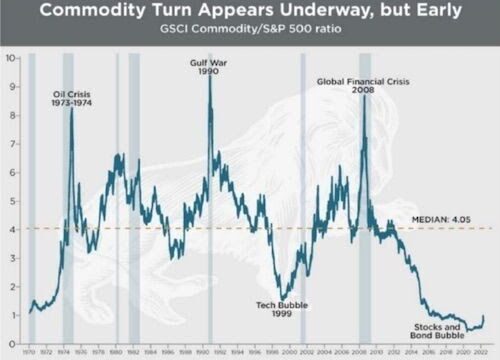

To whet your appetite, we’ll highlight three charts from the report. You might have seen them (or a variation of them) before, but we think it important to highlight them again just as a reminder of the glorious journey ahead of us and how the biggest risk we face is getting off the commodities trade too early.

We’re convinced we have another five years ahead of us before we need to consider getting off the train.

With all that said, it’s easy looking at long-term charts. But when you are at ground zero, watching a coal or oil and gas stock double in the first few months of 2022… only to see it give back half (or even more) over the past couple of weeks… that isn’t fun, and it is what causes many folks to freak out. Which is why keeping the big picture in mind is especially critical.

If you “held the line” over the last few months, we salute you. We like to remind ourselves that good things take time.

THE HOTTEST COMMODITY FEW ARE TALKING ABOUT

Speaking of opportunities in commodities…

We issued a trade alert on it some time ago in Insider, and it seems like the financial world is (finally) starting to wake up to it as well. This piece from Bloomberg caught our attention:

The hottest commodity in the oil industry isn’t crude, gasoline, diesel or jet fuel. Nor is it an exotic petroleum feedstock used to make plastics. The hottest commodity goes by the acronym of OCTG, meaning oil country tubular goods — a verbose way to say drill pipe.

The benchmark price for drill pipe has surged to a record $4,150 per short ton, a 90% increase from $2,300 a year ago. The bounce may not be as high as some others in the oil industry, but it matters more because of the spillover effect: rising drill-pipe prices mean American shale drillers are increasing production more slowly than expected, and that, in turn, means higher oil prices worldwide.

Incredibly, stocks of drill pipe companies have been left for dead. Many are down 80-90% from their peaks and present beautiful asymmetry right now.

ALL THINGS TRANSITORY…

Feels like a lifetime ago, when — back in February 2020 — we started warning that lockdowns will bring about inflation and shortages. Fast forward to today, and this pesky stuff is now part of our daily lives. We recently set up a dedicated inflation channel in our Insider private forum, where members can share their own experiences with all things “transitory”.

A few months ago we mentioned a bizarre shortage of wine bottles and even bottle labels. Member John now reports from the local wine shop:

I noticed this one today. One of my favourite Vinho Verde’s used to be €17.99 a few months back, now €21.99 for a 22% increase

(Although you’d be silly to buy it for that price, this shop is famous for having regular “discounts” that are actually just the fair price)

Member Sean is back with reports of “cakeflation:”

Another M&S cake price update…shall we call it “cakeflation”? Giant cupcakes last year were £3.50, then £3.60, £3.90 and today its £4.25 (21% increase). Swiss rolls were 2 for £2 last year and now they are £2.40 for ONE! (140% increase). The cakeflation index (CKI) is looking grim…

And Vandamme shared a fascinating boots-on-the-ground insight into Europe’s energy crisis:

shortage of electriciy and heat in Europe coming winter seems unavoidable now. My company sells power generators in France, benelux and holland, and I can tell you right now that medium sized generators (7 to 15kW) are selling like ice creams on a hot summer day! I hear clients on the line buying generators for ‘just in case’, they don’t even know what they will put on it , of how they will organise the wiring in thehouse etc. it’s total panic buying because they see their neighbors doing it….

“AT LEAST THEY GOT AIRCON HERE”

Want to know what a country is likely to look like in a few short years to a decade? Just look at their energy policy. Energy is the bedrock, the base layer, the underpinning to modern society.

On that note, Chris shared this ironic story from his recent trip to Turkey:

I was in Antalya, Turkey. At the hotel I was staying in I got chatting to a couple. They were Brits who’d retired to France and were living in an apartment someplace I can’t recall the name of.

You wanna know why they were in Turkey? Because the combination of summer heat and an inability to use the air conditioner had them getting grumpy. And so they were actually in Turkey because it was cheap, but most importantly (and they’d phoned ahead and checked), the aircons are working and amazingly, you’re actually allowed to use them.

So they’d come to Turkey, literally to use the aircons. I remarked how it isn’t the heat that’ll be the issue, but rather the incoming winter. Cold kills more people (5x) than heat. They promptly scoffed at the idea saying “they’ll have sorted it out by then,” and “there is no way they’ll not let us heat our homes.”

And as if right on cue, we came across the following:

We hate to be a wet blanket, but — with everything going on in Europe (and we’ll have more on that in a moment) — we have a nagging feeling that the couple might want to extend their stay in Turkey.