Median Fed Projections

The St. Louis Fed Fred repository recently added a data series on Fed projections. My graph reflects the Median Projections FEDTARMD Series.

Unfortunately the data is annual and it only starts with 2021, looking ahead.

Past projections would be more than a bit humorous if Fred had the data.

The observation dates all say January, but they are really end-of-year projections. Since the data is annual, I used monthly averages which is a bit off as the Fed does not meet once a month.

I added the Factor column to the data download. It is the monthly average rate hike that gets to the Fed’s yearend projections.

Current Yield Chart Notes

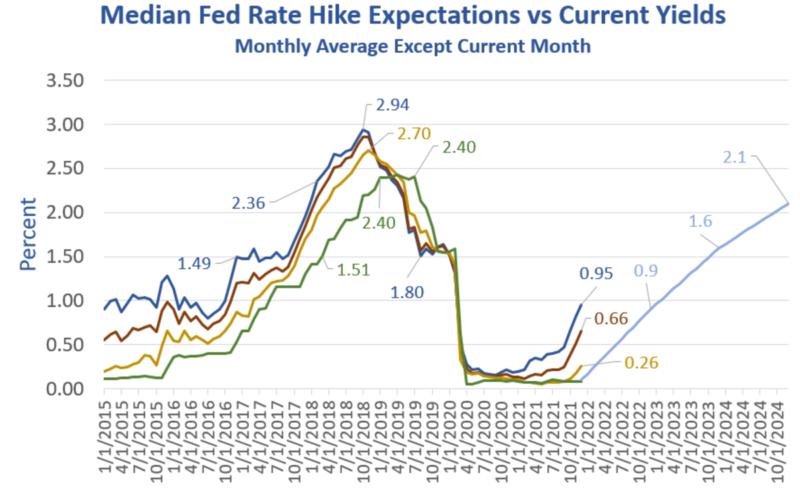

- In June of 2017 the 3-year yield was 1.49%. The Fed Funds Rate (FFR) did not catch up until March of 2018 at 1.51%, about 9 months later.

- In February of 2018 the 3-year yield was 2.36%. The FFR did not catch up until January of 2019 at 2.40%, about 11 months later.

- In October of 2018 the 3-year yield was 2.94%. The FFR never got close.

- In July of 2019, the FFR was still at 2.40% but the 3-year yield collapsed 1.80%

Yields then crashed across the board. And this predated Covid-19 which did not hit until February-March of 2020.

Predictive Value

The only predictive value in any of this was the inversion.

Analysis of Fed Dot Plots shows how totally clueless the Fed has been.

December 2017 Fed Projections

December 2018 Fed Projections

December 2021 Fed Projections

The Fed Expects 6 Rate Hikes By End of 2023 – I Don’t and You Shouldn’t Either

I have more dot plots and discussion in The Fed Expects 6 Rate Hikes By End of 2023 – I Don’t and You Shouldn’t Either

What’s Happening?

Take another look at the lead chart and the 2.94% monthly average yield on the 3-year note in October of 2018.

There was no predictive value in that rate. The yield only got that high because market participants were busy front-running Fed statements.

Amusingly, the Fed considers “forward guidance” a tool. It’s a tool alright, for front-running interest rate bets until they blow up.

The curious thing about all of this is the Fed actually believes and takes cues from the market while giving cues to the market with its own projections!

This article was originally published by Mish Talk.