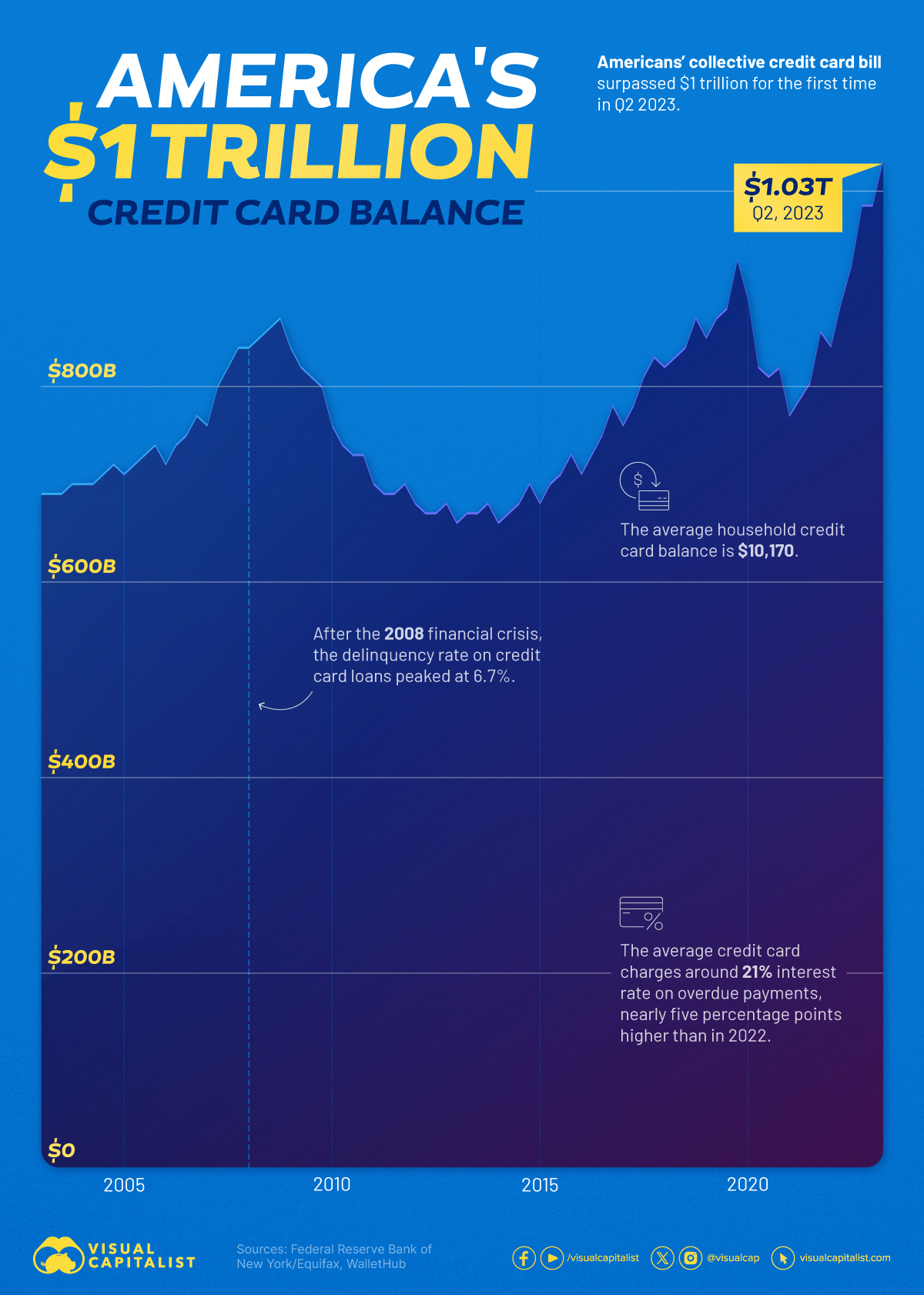

Americans’ collective credit card debt surpassed $1 trillion for the first time in Q2 2023.

Between April 1 and June 30, total credit card balances rose by $45 billion compared to Q1 2023, to $1.03 trillion.

This chart uses data from the Federal Reserve Bank of New York and WalletHub to illustrate the growing credit card debt in the United States.

Over $10,000 Balance per Household

After a sharp contraction in the first year of the pandemic, credit card balances have experienced seven consecutive quarters of year-over-year growth.

In Q2 2023, credit card balances saw the most significant increase among all debt types, including auto loans, student loans, and mortgages.

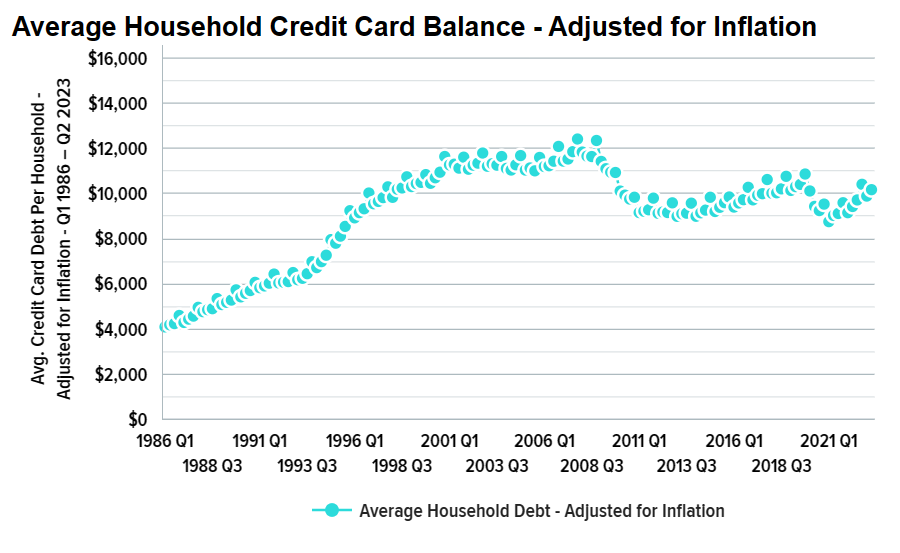

The average household credit card balance was $10,173.87 in June, $2,242.77 below the record set in Q4 2007.

As the Federal Reserve has increased interest rates at a record pace, banks have followed suit.

As the Federal Reserve has increased interest rates at a record pace, banks have followed suit.

The average credit card charges around 21% interest rate on overdue payments, nearly five percentage points higher than in 2022.

Rising Balances May Present Challenges

Credit cards stand out as the most prevalent form of household debt in the U.S. and this prevalence is on an upward trajectory.

According to the Federal Reserve Bank of New York, credit card issuance has been steady over the last few years, averaging about 92 million newly issued cards each year between 2017 and 2019. The pandemic caused a sharp contraction in new credit card issuance, but lending returned across all credit score groups in 2021.

There are currently 70 million more credit card accounts open than in 2019. Approximately 69% of Americans now possess at least one credit card.

“American consumers have so far withstood the economic difficulties of the pandemic and post-pandemic periods with resilience,” New York Fed researchers wrote.

“However, rising balances may present challenges for some borrowers,” they added, “and the resumption of student loan payments this fall may add additional financial strain for many student loan borrowers.”