How do the world’s richest people invest their money?

This article was written by Dorothy Neufeld and originally published by Visual Capitalist.

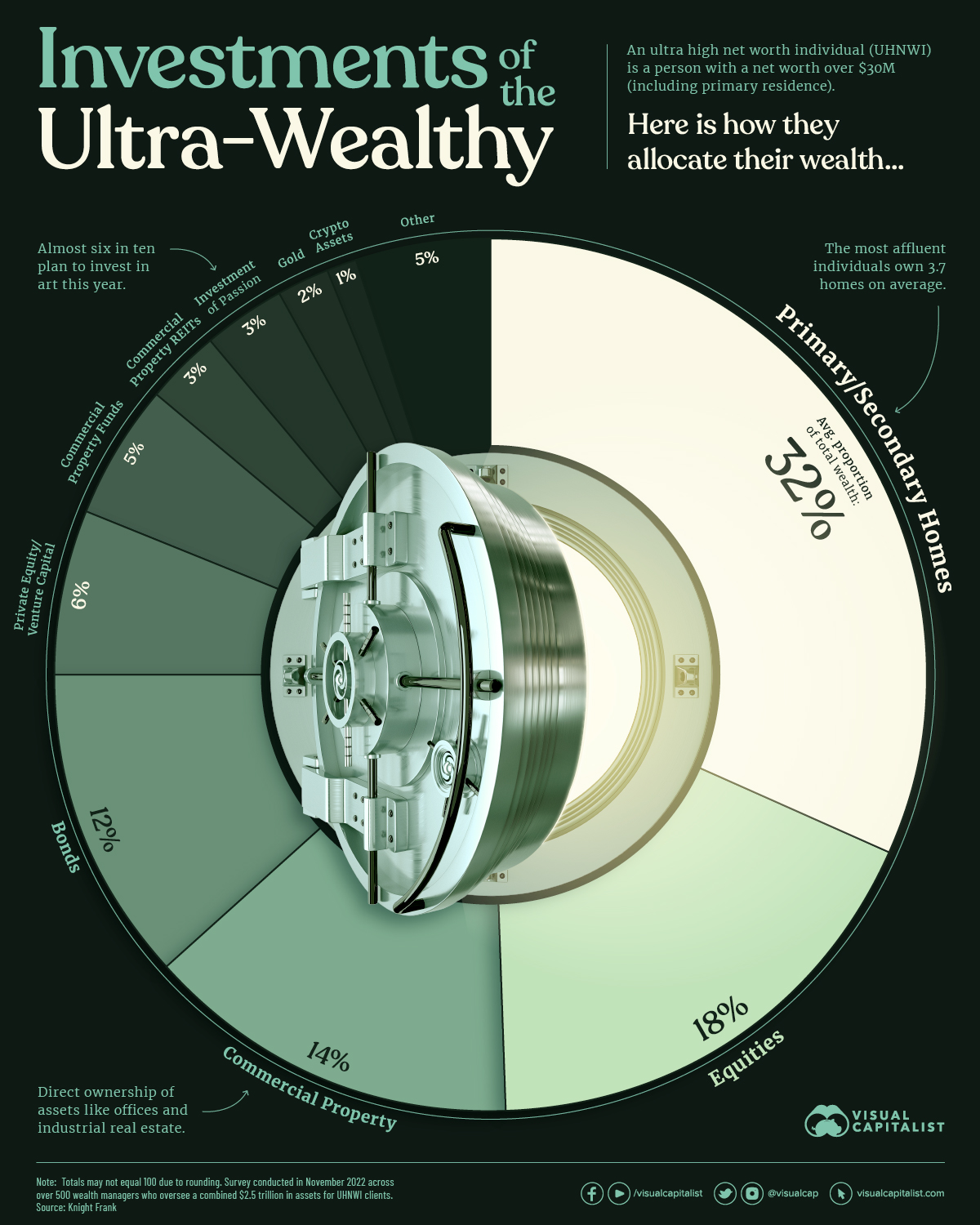

This graphic shows how ultra high net worth individuals (UHNWIs)—people with a net worth of $30 million or more including their primary residence—allocate their wealth based on data from Knight Frank’s 2023 Wealth Report.

How the Ultra-Wealthy Invest

Below, we show where UHNWIs invest their fortunes, based on a global survey of over 500 wealth managers, family offices, and private bankers that oversee a combined $2.5 trillion in assets:

| Rank | Asset | Average Proportion of Total Wealth |

|---|---|---|

| 1 | Primary and Secondary Homes | 32% |

| 2 | Equities | 18% |

| 3 | Commercial Property | 14% |

| 4 | Bonds | 12% |

| 5 | Private Equity / Venture Capital | 6% |

| 6 | Commercial Property Funds | 5% |

| 7 | Commercial Property REITs | 3% |

| 8 | Investment of Passion (e.g. art, cars, wine) | 3% |

| 9 | Gold | 2% |

| 10 | Crypto Assets | 1% |

| 11 | Other | 5% |

As the table above shows, primary and secondary homes make up 32% of total wealth, the largest share across assets. The average UHNWI owns 3.7 homes.

Investments in stocks comprised almost 20% of UHNWI wealth, with those in the Americas having the highest share of wealth in equities (33%) followed by Europe (28%) and Asia (26%).

Private equity and venture capital investments, which include investments in startup companies that have not yet gone public, accounted for 6% of total wealth on average. A separate report shows that the average investment in a private equity company ranges between $1.8 million and $6.9 million for UHNWI investors.

Luxury Investments of the Ultra-Rich

Investments of passion, which include a range of luxury items from art to classic cars, make up an average 3% of the total wealth of the ultra-rich.

In 2023, nearly six in 10 UHNWIs said they plan to purchase art.

| Likely to Purchase in 2023 | Global Average |

|---|---|

| Art | 59% |

| Watches | 46% |

| Wine | 39% |

| Classic Cars | 34% |

| Jewelry | 33% |

| Luxury Handbags | 20% |

| Rare Whiskey Bottles | 18% |

| Furniture | 14% |

| Colored Diamonds | 9% |

| Coins | 8% |

Many of these items retain their value over time. In fact, all 10 of these items increased in value over 2022 despite a challenging economic environment which saw the S&P 500 fall over 19%.

The art market saw prices increase 29% last year, the highest across luxury items. Luxury cars (25%) and watches (18%) also saw some of the highest price increases.

The Growth of the Uber-Affluent

In 2022, there were roughly 579,000 people globally with wealth that exceeded $30 million. New York, Tokyo, and San Francisco are home to the most ultra-rich individuals worldwide. Over the next five years, this number is projected to reach 744,000—a 29% increase.

As these numbers continue to climb, demand for luxury real estate, equity investments, and luxury items will likely grow given the investment patterns of the ultra-wealthy illustrated today.