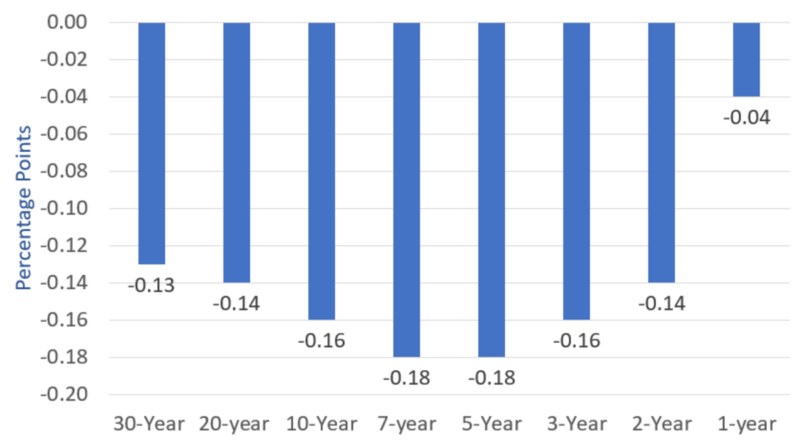

One Day Change Synopsis

- The markets were closed on Thanksgiving, November 25. The chart reflects the change between November 24 and November 26.

- Yields were down across the board from 1-year through 30-years.

- 7-year and 5-year yields declined the most, 18 basis points.

Omicron Covid-19 Threat

The response was due to global lockdowns in at least 9 countries on a new Covid-19 variant labeled Omicron.

Treasury Yields October 1 vs November 26

Change in treasury Yield Since October 1

Change Notes

- The Yield Curve has been flattening since late September or early October.

- I have been using October 1 for my starting point in previous comparisons and stick with that date.

- Since October 1 30-year and 20-year yields have declined. The 10-year yield is flat and everything else is up.

- As in previous updates, the 3-year note continues to be the spot most sensitive to expected rate hikes.

- The 30-year yield is down 21 basis points and the 3-year yield is up 32 basis points. This represents 53 basis points of relative tightening.

Inversion Notes

- Inversion occurs when longer-term treasuries have a lower yield than shorter-term treasuries.

- The 30-year treasury (1.83%) and 20-year treasury (1.89%) are inverted by 6 basis points. This has been ongoing for weeks.

- There is only 8 basis points of difference between the 7-year and 10-year notes. I expect this will be the next spot to invert.

- Inversion is a recession signal but the inversions are not deep enough yet to signal anything

The yield curve plunge was expected in this corner, but I had no idea in advance of the new covid-19 variant.

Rather, expected rate hikes just seldom happen and I felt far too many were priced in.

This article was originally published by Mish Talk.